Ethereum, the second biggest cryptocurrency, has been struggling to get back above $3,000 since August. It’s been hanging around $2,600 for a while, but things might be looking up.

A Bullish Signal: Funding Rates

Analysts are seeing a positive change in Ethereum’s funding rates. This means traders are becoming more confident in the price going up, especially after the recent Fed interest rate cut.

Funding rates are basically payments between traders to keep the price of Ethereum futures contracts close to the actual price. When funding rates go up, it usually means more people are betting on the price going up, which can push the price higher.

Analysts say that if these funding rates stay high, Ethereum could continue its climb towards $3,000. But if they drop, it could hurt the bullish momentum.

Breaking Through $2,600

Ethereum recently broke through the $2,600 level, which is a big deal. It shows that people are starting to believe in Ethereum again. This breakout could be the start of a move back to $3,000.

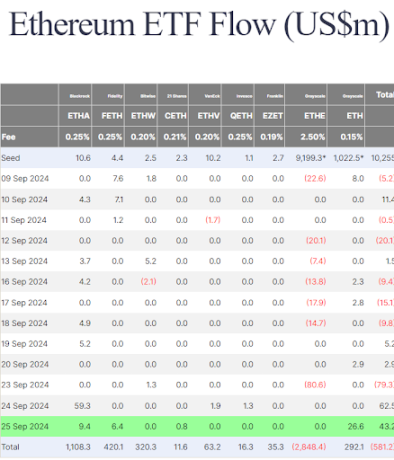

Institutional Interest

Even institutional investors are getting more interested in Ethereum. They’re buying up Ethereum ETFs, which are like stocks that track the price of Ethereum. This shows that big money is starting to flow into the market, which could also help push the price higher.

The Road Ahead

It’s still too early to say for sure if Ethereum will hit $3,000 again. But the recent positive signs, like the rising funding rates and institutional interest, are giving investors hope. If these trends continue, Ethereum could be on its way back to the top.