Ethereum has been on a roll, bouncing back from a dip to $2,100 and gaining a solid 25% since August 2024 lows. The price is eyeing a push past $2,800 and even $3,000, but there’s a potential roadblock: a huge influx of Ethereum tokens hitting the market.

A Flood of Ethereum: 143,000 ETH Ready to Be Unchained

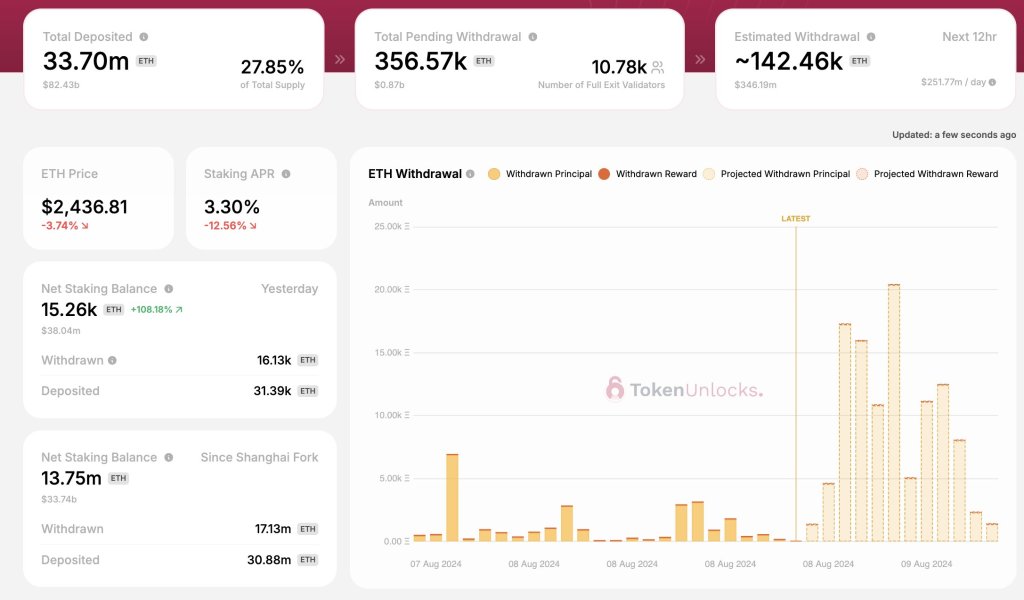

Get ready for a potential supply shock! A whopping 143,000 ETH, worth nearly $350 million, is set to be withdrawn from the Ethereum network today. And that’s just the beginning. Another 212,000 ETH will be available for trading in the coming days. This is a significant amount of Ethereum entering the market, which could put downward pressure on prices.

Why the Surge?

This influx of Ethereum comes from validators who have been staking their tokens to secure the network. Validators earn rewards for their efforts, and they’re now able to withdraw some of those rewards. These withdrawals are different from the block rewards distributed every 13 seconds.

Will Prices Take a Hit?

While the market expects a supply spike, analysts aren’t sure if this will lead to a sell-off. However, if these tokens are sold, it could slow down Ethereum’s recovery.

History Suggests Caution

Historically, large unlocks of Ethereum have coincided with price drops. In the last three months, unlocks of 150,000 to 220,000 ETH have been followed by price dips.

Can Bulls Overpower the Supply Surge?

Ethereum is currently in recovery mode, but the downtrend from the recent dip is still present. The immediate resistance level is around $2,600. If buyers can push through this level, Ethereum could rally towards $3,000. However, the influx of Ethereum could make this climb more challenging.

The next few days will be crucial for Ethereum. Will the bulls be able to overcome the supply surge and push prices higher, or will the market succumb to selling pressure? Only time will tell.