Ethereum’s price has dipped recently, but a big shift is happening behind the scenes. Companies are quietly buying up huge amounts of ETH, similar to how companies bought Bitcoin before.

The Treasury Trend: Lots of ETH Locked Up

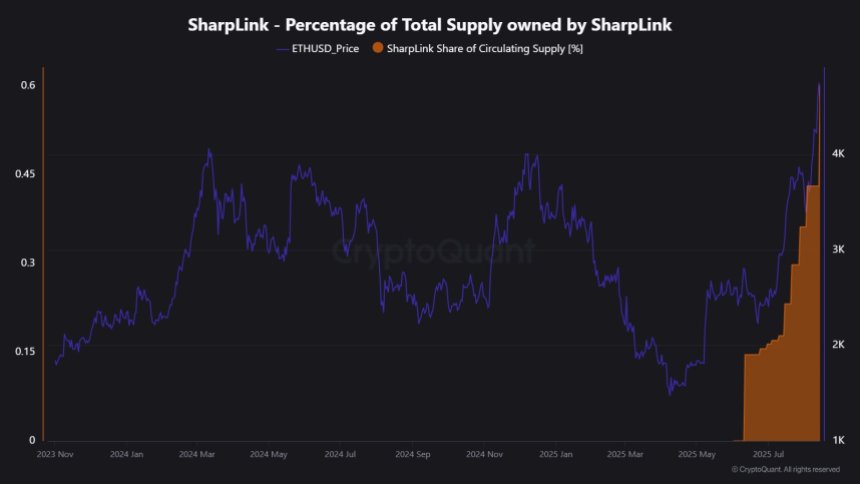

Over 16 companies now hold nearly $11 billion worth of ETH (that’s 2,455,943 ETH!), storing it in their corporate treasuries. This reduces the amount of ETH available to trade, potentially driving up the price. It’s like a corporate gold rush for Ethereum.

But Ethereum Isn’t Bitcoin

Unlike Bitcoin, which has a limited supply, Ethereum’s supply can change. New ETH is created, and some is also “burned” (destroyed) through a process called EIP-1559. This means the total supply isn’t fixed, which creates both opportunities and risks.

Risks of Concentration and Leverage

While the treasury strategy is good for Ethereum in the long run, there are some risks:

- Concentration: A few companies hold a significant chunk of this ETH. If they decide to sell, it could cause a big price drop.

- Leverage: Lots of people are using borrowed money to bet on ETH’s price (futures trading). This makes the market more volatile. A small price drop can trigger a chain reaction of forced selling, as we saw in August when a $2 billion drop caused a 7% price fall.

Where is the Price Headed?

Ethereum’s price is currently around $4,227 after a recent drop from almost $4,800. However, it’s still above important long-term average prices, suggesting the overall trend is still upward.

- Bullish Scenario:

If the price stays above $4,100-$4,200, it could climb back towards $4,800 and beyond.

If the price stays above $4,100-$4,200, it could climb back towards $4,800 and beyond. - Bearish Scenario: If it falls below that level, it might drop to $3,600-$3,800.

The next few days will be crucial in determining which way the price goes. The treasury strategy might boost Ethereum in the long run, but the risks of concentrated holdings and high leverage are something to keep an eye on.