Ethereum has been on a wild ride lately. The whole crypto market’s been down, and ETH is struggling to bounce back. Things got even more uncertain after President Trump’s recent executive order about a Bitcoin reserve. While some thought this would be good news, it actually just added to the confusion.

A Bullish Signal?

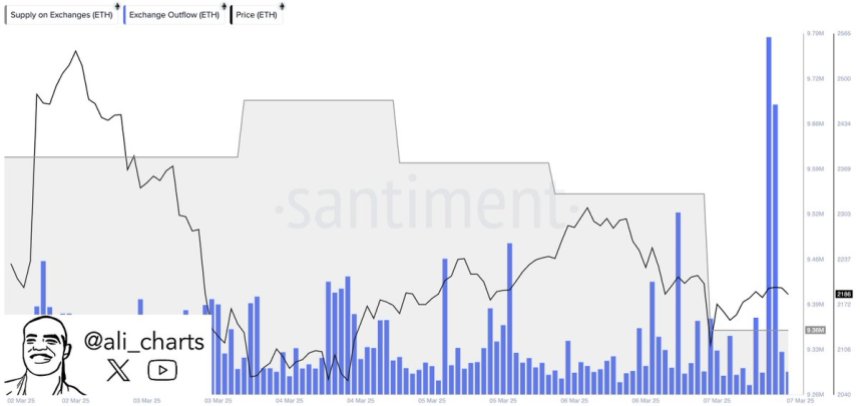

Despite all the negativity, there’s a glimmer of hope. Data shows a massive 330,000 Ethereum has been pulled off exchanges in just 72 hours! This is a big deal. It usually means investors are moving their ETH to private wallets, which suggests less selling and possibly long-term holding.

Ethereum’s Recent Struggles

ETH’s price has taken a serious hit – it’s down over 50% since December. This has caused a lot of panic selling. Many are wondering if the much-anticipated altcoin season will even happen this year.

The Potential for a Supply Squeeze

This massive withdrawal of ETH from exchanges could lead to a “supply squeeze.” Basically, less ETH available on exchanges means it’s harder for sellers to push the price down. If buyers start stepping in, this could really boost the price.

Where ETH Stands Now

Right now, ETH is trading around $2,130. It’s been struggling to break above $2,500. If it can’t hold above $2,100, things could get worse. A drop below $2,000 would be a major blow. Conversely, breaking above $2,500 would be a strong sign of recovery.

What’s Next for Ethereum?

The next few days are crucial. If the positive trend of ETH leaving exchanges continues and buying pressure increases, we could see a significant price increase. But if selling pressure keeps up, another price drop is definitely possible. It’s a waiting game to see if the bulls or the bears will win this round.