Ethereum has been steadily climbing back up after a recent dip, and analysts are buzzing about a potential breakout to $3,000.

Ethereum’s Accumulation Phase

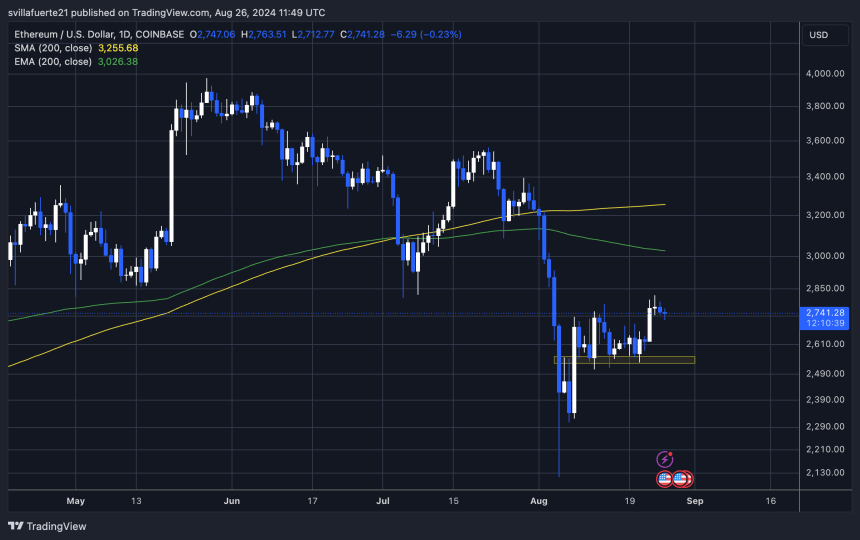

After dropping to $2,116 just a few weeks ago, Ethereum has been on a strong recovery path. This upward trend has caught the attention of investors, who are watching closely for signs of a bigger move.

Technical Analysis: A Breakout is Brewing

Technical analysis suggests that Ethereum is poised to break out of its current range and head towards higher prices. One analyst, Castillo Trader, highlighted a potential path where Ethereum could retest a lower demand level around $2,611 before pushing towards the key $3,000 mark.

The $3,000 level is important because it’s both a psychological barrier and a previous support level. Breaking through this resistance could signal a sustained uptrend for Ethereum.

What to Watch for in Ethereum’s Price

Ethereum is currently trading around $2,743, and its next move could go either way.

- Retest and Rise: Ethereum might dip back down to around $2,500 before attempting to break through $3,000. This would give the market a chance to solidify its footing for a sustained upward move.

- Direct Breakout: However, given recent volatility, Ethereum could also bypass the retest and push straight to $3,000.

Another key level to watch is the daily 200 Exponential Moving Average (EMA), currently sitting at $3,026. Breaking above this EMA would be a strong indication of bullish momentum.

The Bottom Line

The next few days could be crucial for Ethereum. If it can break through $3,000 and close above the 200 EMA, it could signal a major bullish run for the cryptocurrency. Investors and traders are watching closely to see what happens next.