Ethereum’s price has rebounded to around $2,800 after a recent dip. This recovery seems linked to some serious whale activity.

Whale Withdrawals: A Billion Dollar Exodus

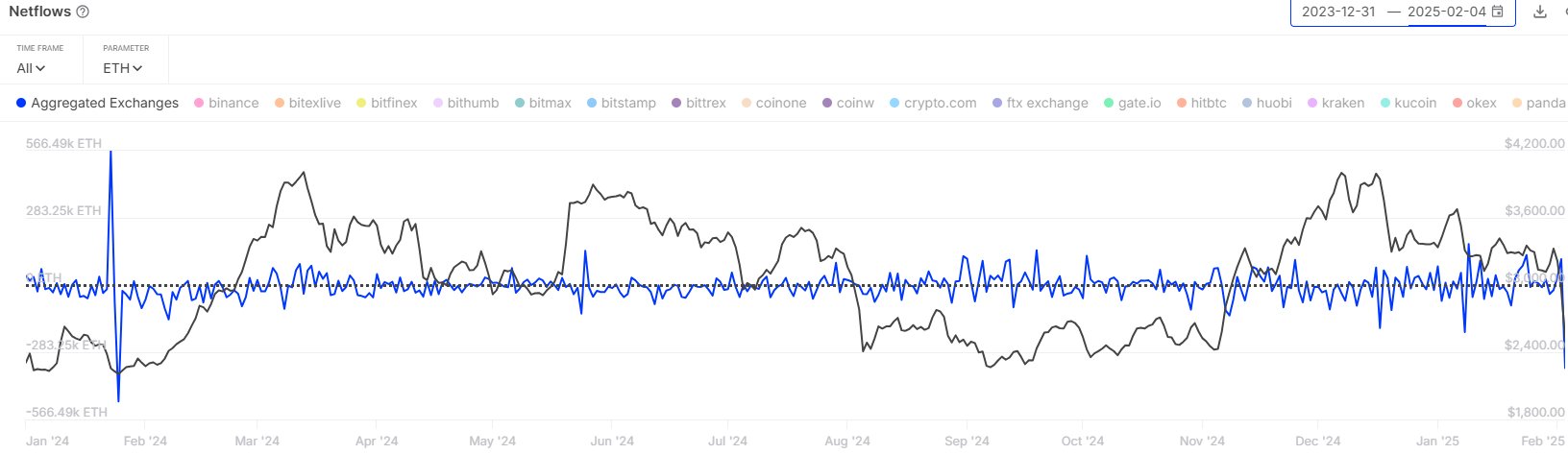

Data shows massive withdrawals of Ethereum from cryptocurrency exchanges. Specifically, the “Exchange Netflow” – which tracks the overall movement of ETH in and out of exchanges – spiked negatively. This means a lot more ETH left exchanges than entered. Why is this significant? Because people usually move their crypto to exchanges to sell it. So, a large outflow often suggests buying and accumulation, which is generally bullish for the price.

The numbers are staggering: Yesterday alone, investors pulled roughly 350,000 ETH (about $982 million!) from exchanges. This was the biggest single-day outflow since January 2024! It looks like whales were taking advantage of the lower prices to buy more ETH.

The Impact on Ethereum’s Price

This whale buying spree seems to have helped put a floor under Ethereum’s price and fueled its recovery. The Exchange Netflow will be a key indicator to watch. Continued outflows are a positive sign, while increased inflows could signal further price drops.

USDC on the Rise: More Fuel for the Fire?

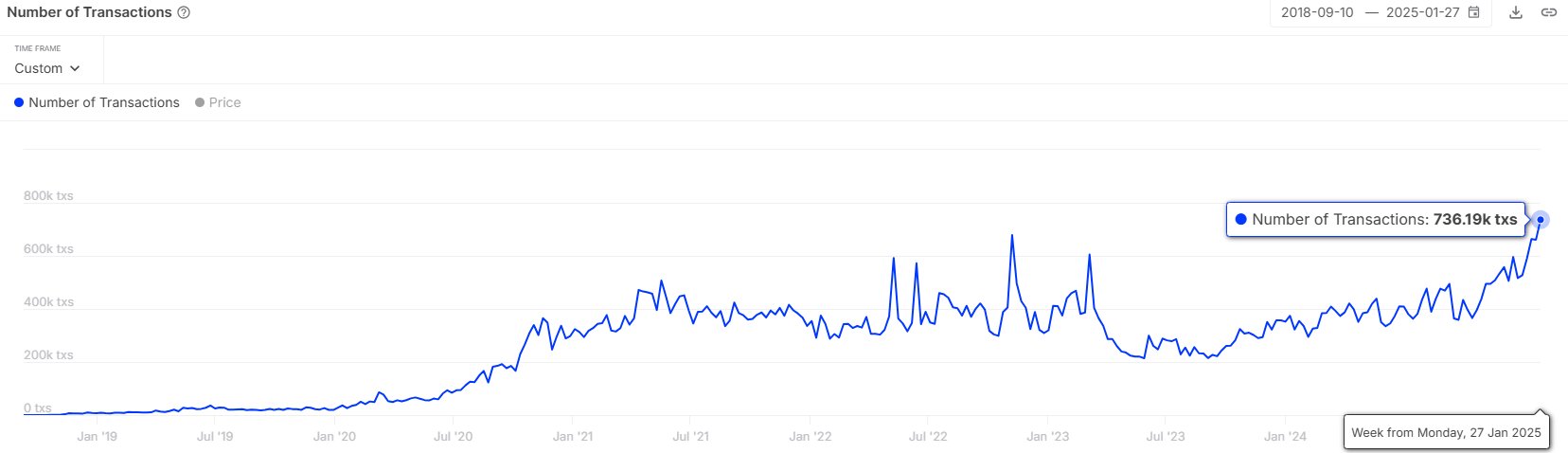

Interestingly, the USDC stablecoin is also seeing a surge in transactions – up over 119% year-over-year. Stablecoins often act as a source of funds for more volatile assets like Ethereum, so this increased activity could be another positive sign for the market.

Current Ethereum Price

As of now, Ethereum is trading around $2,800, although it’s still down more than 11% over the past week.