Revenue Model

Ethereum generates revenue by charging transaction fees to users. These fees are burned, reducing the supply of ETH and increasing its value. The blockchain also issues new ETH as rewards to validators, but this dilutes the holdings of existing ETH owners.

Reduced Transaction Costs

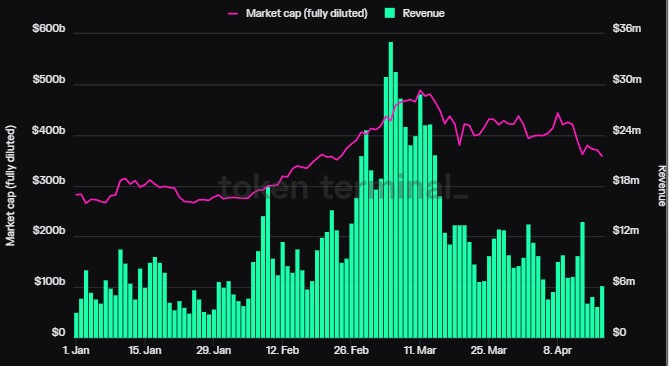

The Dencun upgrade and the introduction of blobs reduced congestion and transaction costs on Ethereum and its Layer 2 networks. This made Ethereum more attractive to users and developers, leading to an 18% increase in revenue.

Market Correction

Despite the revenue growth, Ethereum’s revenue has declined by over 52% in the past 30 days due to market corrections and decreased investor interest.

Current Market Conditions

As of today, ETH is trading at $3,042. It remains to be seen whether the reduced fees and potential increase in trading volume will continue to drive the price of ETH higher in the second quarter of the year.