Big investors in Ethereum, known as whales, are snapping up ETH like crazy. This is happening even though the price of ETH has been dropping lately.

Whales are Loading Up

Data shows that whales bought a whopping $1 billion worth of ETH on July 24th alone. That’s on top of the almost $400 million they bought the day before! This buying spree has been going on for a week, with the amount of ETH flowing into whale wallets increasing by over 28%.

At the same time, whales are selling less ETH than usual. This shows they’re really optimistic about Ethereum’s future, even though it’s not performing well right now.

The Spot Ethereum ETF Effect

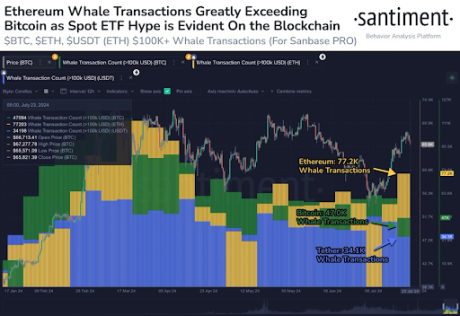

Experts believe this whale activity is linked to the launch of Spot Ethereum ETFs on July 23rd. These ETFs allow investors to buy and sell ETH on traditional stock exchanges, which could make Ethereum more accessible and popular.

Since the ETFs launched, the amount of ETH being transferred on the Ethereum network has skyrocketed. This is a clear sign that people are buying and selling ETH more than ever before.

Could the ETFs Be a Double-Edged Sword?

While the ETFs are expected to boost Ethereum’s price in the long run, they might actually cause a short-term dip.

This happened with Bitcoin earlier this year, when the launch of Spot Bitcoin ETFs led to a drop in price. The reason? Investors were selling off their Bitcoin holdings in Grayscale’s Bitcoin Trust (GBTC) to buy into the new ETFs.

The same thing could happen with Ethereum. Grayscale’s Ethereum Trust (ETHE) saw a huge outflow of $484.1 million on its first day of trading, which is even bigger than the outflow from GBTC.

This could mean that Ethereum could face a lot of selling pressure in the coming days and weeks. On the second day of trading, the Spot Ethereum ETF also saw a large outflow of $326.9 million, which could be just the beginning of a bigger trend.

It’s still early days, but it looks like the launch of the Spot Ethereum ETFs might be a bit of a rollercoaster ride for ETH.