Ethereum has been a bit sluggish lately, with prices struggling to break above $2,400 and $2,800. But don’t let that fool you, most ETH holders are still optimistic! They believe the price will bounce back and even surpass the July highs of around $3,500.

More Than Half of ETH Holders Are Making Money

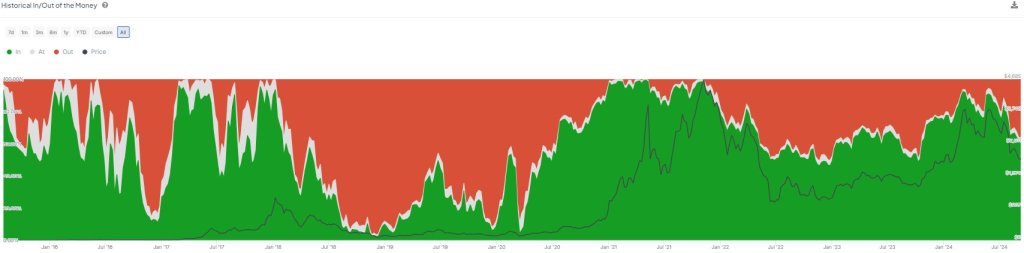

Data from IntoTheBlock shows that a whopping 61% of all ETH holders are currently in the green. This is a pretty impressive feat, considering the price has dropped nearly 35% from its July peak and almost 45% from its 2024 high. This resilience shows that many people are still holding onto their ETH, even with the recent price dips.

A Sign of Optimism

This high percentage of profitable holders is a good sign for the Ethereum ecosystem. It indicates that many people are confident in the future of the coin, even during a bear market. In previous bear markets, the percentage of profitable holders dropped significantly. For example, during the 2019/2020 bear market, the percentage fell to as low as 10%.

Whales Are Holding Strong

Data from Dune shows that the top 1,000 ETH addresses control a huge chunk of the circulating supply – over 38%. If IntoTheBlock’s data is accurate, most of these “whales” are in the green and are likely to hold onto their ETH, which could put upward pressure on the price.

A Crucial Support Level

One analyst has identified a critical support level for ETH between $2,290 and $2,360. This is where a lot of ETH was bought, and if the price breaks below this level, the analyst predicts a sharp drop to $1,800.

In short, while Ethereum is facing some headwinds, the majority of holders are still optimistic. The price needs to break through the $2,290-$2,360 support level to avoid a potential drop. /p>