Ethereum’s price has been on a downward slide for a while now, and things haven’t gotten any better since the launch of spot ETH ETFs in the US.

Big Money Leaving the Grayscale Ethereum Trust

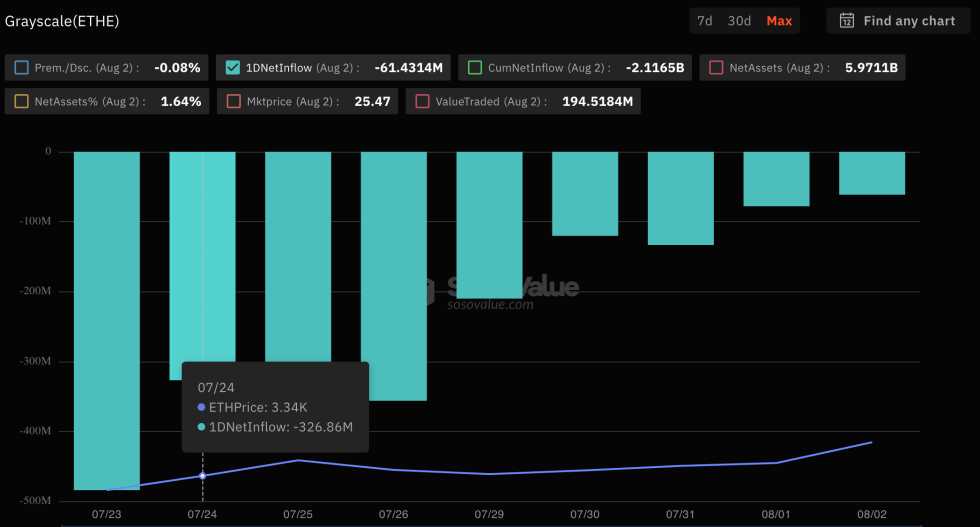

One of the biggest reasons for the slump could be the massive amount of money flowing out of the Grayscale Ethereum Trust (ETHE). In the past two weeks, over $2.1 billion has been withdrawn from the fund. This is a huge amount, especially considering that over $1.5 billion was withdrawn in the first week alone.

ETF Outflows Continue, but at a Slower Pace

While the total outflow from all ETH ETFs was significant last week ($169.35 million), it was less than half of the amount withdrawn in the debut week. This suggests that the initial excitement surrounding the ETFs might be fading.

Grayscale Holders Cashing Out

It seems like many people who held shares in Grayscale’s ETHE are finally cashing out. They were unable to do this for years, but now that spot ETFs are available, they have more options.

Ethereum Price Under Pressure

All this money flowing out of ETHE is putting a lot of pressure on the Ethereum price. As of right now, ETH is trading around $2,907, down over 2% in the past 24 hours. The price has fallen more than 10% in the past week and almost 8% in the past month.

Still Second Largest Crypto

Despite its recent struggles, Ethereum remains the second-largest cryptocurrency, with a market cap of over $347 billion.

Is the ETF Hype Over?

The recent outflow from the Grayscale Ethereum Trust and the slowing down of ETF inflows might indicate that the initial excitement surrounding spot ETH ETFs is waning. It remains to be seen whether the Ethereum price can recover, or if this is just the beginning of a longer downward trend.