Ethereum ETF Approval Sparks Market Movement

The approval of Ethereum ETFs has sparked speculation about the cryptocurrency’s price movements. However, large transfers of ETH to exchanges have raised concerns about profit-taking and potential market volatility.

Sell-Off Amidst Greenlight?

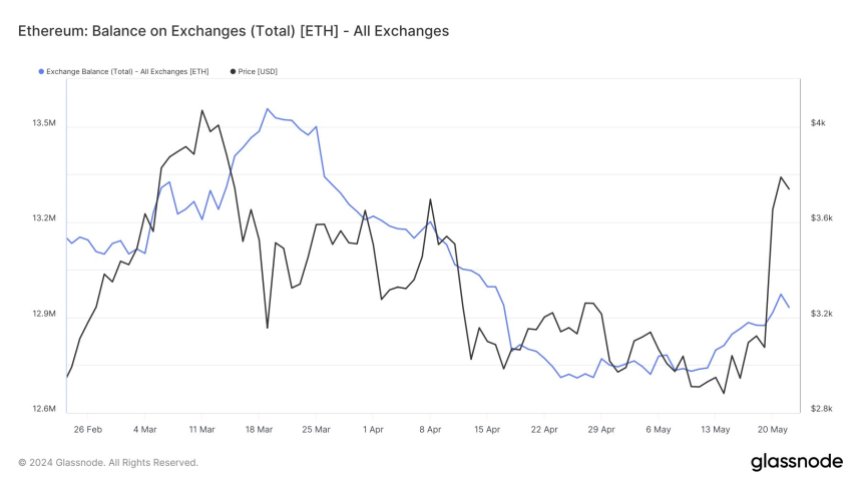

Crypto analyst Ali Martinez points to a transfer of 10,000 ETH by Ethereum founder Jeffrey Wilke to Kraken. Additionally, a surge in ETH balances on exchanges indicates increased tokens available for sale. This, coupled with Wilke’s transfer, suggests the possibility of a sell-off or profit-taking.

Technical Analysis

Martinez highlights a demand zone between $3,820 and $3,700, where significant ETH purchases were made. This zone could provide support. If it fails, the next support level lies between $3,580 and $3,462.

On the upside, the most significant resistance barrier is between $3,940 and $4,054. A daily close above $4,170 would invalidate the bearish outlook and potentially trigger a move towards $5,000.

Current Price and Outlook

As of writing, ETH’s price is $3,719, showing a slight retracement. However, it remains within the crucial demand zone. The impact of the ETF launch on price action remains to be seen.