Ethereum (ETH) is expected to do better than Bitcoin (BTC) after the launch of spot Ethereum exchange-traded funds (ETFs), according to crypto analytics firm Kaiko.

A Shift in the Market

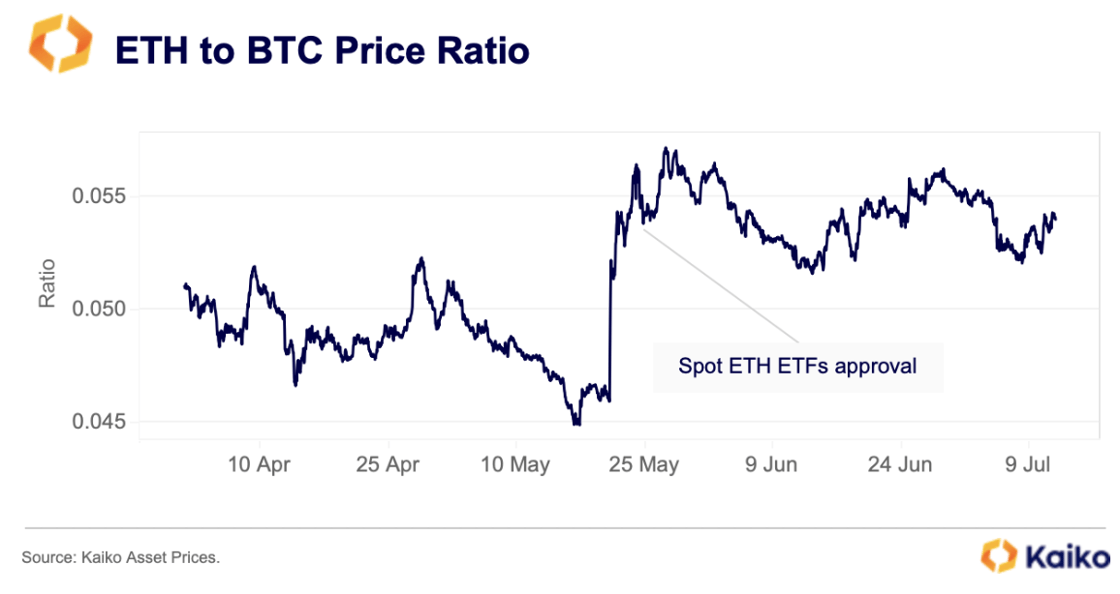

The mood in the crypto market has changed since the U.S. Securities and Exchange Commission (SEC) approved spot Ethereum ETFs in May. While the ETFs haven’t started trading yet, the ETH/BTC ratio has risen significantly, suggesting ETH could outperform BTC following the launch.

The ETF Launch

Bloomberg ETF expert Eric Balchunas expects the ETH ETF to launch on July 23rd.

Not Everyone Is Convinced

However, not everyone is convinced that the ETF launch will be a game-changer for Ethereum.

Crypto analyst Benjamin Cowen believes that the Federal Reserve’s monetary policy will have a bigger impact on ETH’s price than the ETF. He argues that past bullish narratives about Ethereum haven’t materialized, suggesting that monetary policy is the key driver.

Cowen believes that the ETF launch won’t necessarily prevent the ETH/BTC valuation from staying at relatively low levels. He points out that the ratio has already fallen significantly from its 2022 peak, despite the bullish narratives surrounding Ethereum’s transition to proof-of-stake.

It remains to be seen whether the launch of spot ETH ETFs will give Ethereum the boost that many expect. However, the market is certainly paying attention.

/p>