Ethereum is outperforming Bitcoin, holding steady above the $3,000 to $3,300 range. While prices dipped yesterday, ETH holders are optimistic, hoping for a push past $4,000.

Staking Soars, Validators Reach a Million

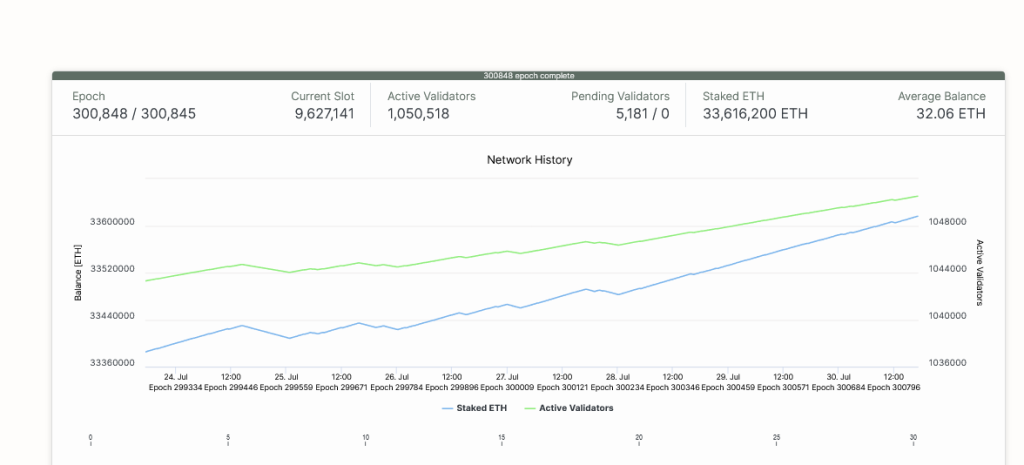

A record-breaking 28% of all ETH in circulation is now locked up for staking, with over 33.6 million ETH staked. This means over a million validators are securing the Ethereum network. Each validator has locked up an average of 32.06 ETH, contributing to the growing scarcity of the coin.

ETH Exits Exchanges, Demand Heats Up

Holders are pulling their ETH from exchanges, indicating confidence in the asset. The amount of ETH held on exchanges has dropped significantly from 32.5 million in 2021 to just 16.6 million today. This suggests that holders are either holding onto their ETH or using it for other activities like DeFi or staking.

The launch of spot Ethereum ETFs in the US is expected to further increase demand for ETH. As the coin becomes scarcer, the demand from these ETFs could push prices higher.

Looking Ahead: $4,000 on the Horizon?

Ethereum has found resistance at $3,500, but if it can maintain support around the $3,000 to $3,300 zone, it could potentially rise further. The combination of record staking, increasing scarcity, and growing demand from ETFs suggests that Ethereum is poised for continued growth.