Ethereum is currently in a precarious position, hovering between potential gains and losses. The crypto market is hoping for a rally, but analysts are concerned about a possible correction.

A Crucial Support Level

A key indicator suggests that if Ethereum falls below $2,300, a significant sell-off could occur. This level represents a major demand zone, where a large number of investors bought Ethereum. If the price breaks below this level, these investors might sell to protect their investments, leading to a downward spiral.

However, if Ethereum manages to hold above $2,300, it could signal a positive shift in sentiment. Investors might gain confidence, potentially leading to a rally.

Technical Analysis: The Next Few Days Are Critical

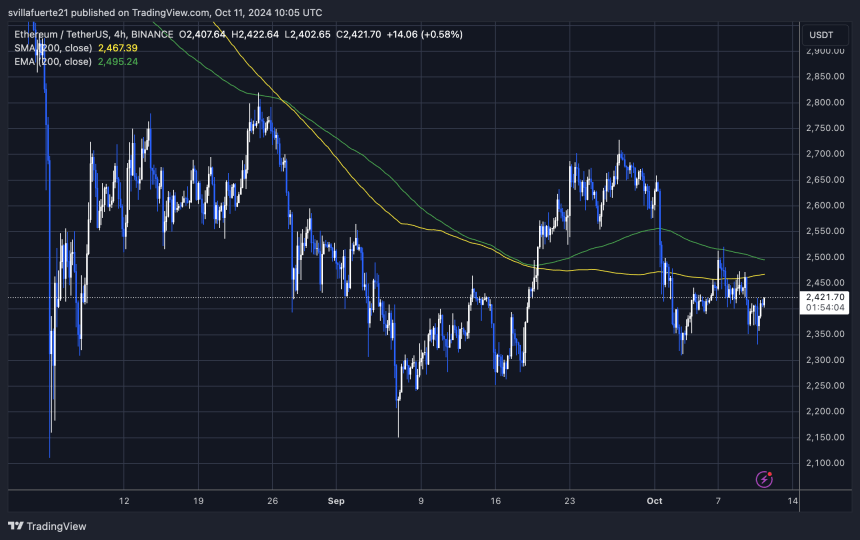

Ethereum is currently trading around $2,420, having recently rebounded from a lower demand zone. However, it’s still below key resistance levels, including the 200-day moving average and the 200-day exponential moving average.

If Ethereum breaks above these resistance levels, it could signal a bullish trend and lead to further gains. However, if it fails to break through, the risk of a deeper correction increases, potentially pushing the price down to $2,150.

The Bottom Line

Ethereum’s price action in the coming days will be crucial in determining its future trajectory. If it can hold above $2,300 and break through the key resistance levels, it could see significant gains. However, if it falls below $2,300, a sell-off could occur, potentially leading to further losses. Investors and traders are closely watching these key levels as they try to predict Ethereum’s next move.