Ethereum has been struggling lately, just like most other cryptocurrencies. Prices have been dropping since early August, even though there were some brief rallies.

Holding the Line

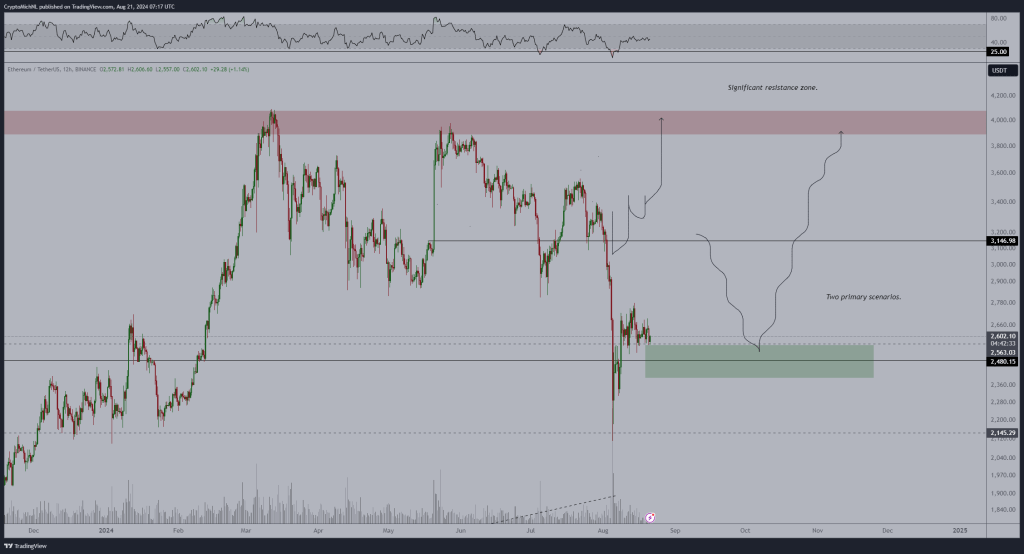

The good news is that buyers have been able to keep Ethereum above $2,500, despite the selling pressure. One analyst believes this is crucial for the price to recover. If Ethereum can stay above this level, it could signal a bullish trend.

Bull Flag Formation

The recent price action has formed a “bull flag” pattern, which suggests a potential breakout. This pattern usually indicates that a price is consolidating before a strong upward move.

The $2,500 Anchor

The analyst believes that if Ethereum can hold above $2,500, it could surge to $3,150 in the near future. This would be a significant recovery from the recent sell-off.

Spot ETFs and Ecosystem Growth

The analyst believes that the upcoming launch of spot Ethereum ETFs will drive demand for the cryptocurrency. These ETFs allow institutional investors to invest in Ethereum without having to buy the underlying asset directly.

Positive Developments

Ethereum’s co-founder, Vitalik Buterin, has also highlighted some positive developments in the Ethereum ecosystem, including lower gas fees and the growth of layer-2 solutions like Base, Arbitrum, and Optimism. These factors could also contribute to a price increase.

Overall, the future of Ethereum remains uncertain, but the potential for growth is still there. The key for now is for Ethereum to hold above $2,500 and for the positive developments in the ecosystem to continue. /p>