Ethereum’s price recently bounced back strongly after weeks of decline, giving some hope to investors. Let’s dive into what’s happening.

A Quick Rebound Amidst Uncertainty

Ethereum jumped over 21% from its low of $1,380 in a matter of hours. This sudden surge followed some positive news regarding US tariffs (excluding China), which temporarily boosted the overall market sentiment. However, the situation remains volatile, with global economic and political uncertainty still a major factor. Since its peak, Ethereum’s price has dropped over 60%, raising concerns about a potential bear market.

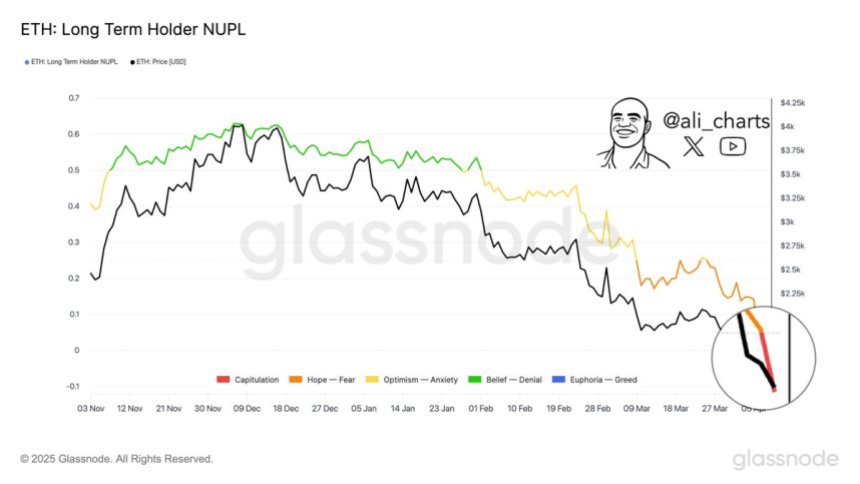

Long-Term Holders Capitulating?

Interestingly, data shows that long-term Ethereum holders are starting to sell, even at a loss. This “capitulation” is often seen as a sign that a market bottom might be near. Analysts like Ali Martinez believe this could be a good buying opportunity for those willing to take on some risk. Historically, this type of capitulation has preceded significant price rebounds.

Technical Analysis: A Bullish Pattern?

Technically, Ethereum is showing some bullish signs. A potential “Adam & Eve” reversal pattern is forming on the charts. If the price can break above $1,820 and then the $1,900 resistance level (which includes key moving averages), it could signal a sustained recovery. However, failure to break these resistance levels might mean Ethereum remains stuck in a trading range, potentially falling back towards the $1,300 support.

The Bottom Line: A Crucial Crossroads

Ethereum is at a critical juncture. While the recent bounce is encouraging, significant uncertainty remains. The next few days will be crucial in determining whether this recovery is sustainable or just a temporary reprieve. The overall market sentiment and whether Ethereum can break key resistance levels will dictate its short-term future.