Ethereum (ETH) has been on a rollercoaster ride lately. After hitting a high last week, it’s dropped 10.3% and analysts are worried it could be headed for another correction.

Whales Dumping ETH

The recent downturn has been fueled by some big players selling off their ETH. One whale, who had been inactive for two years, dumped 12,010 ETH (worth $31.6 million) onto Kraken a week ago. They followed that up with another 19,000 ETH sale just a few days later.

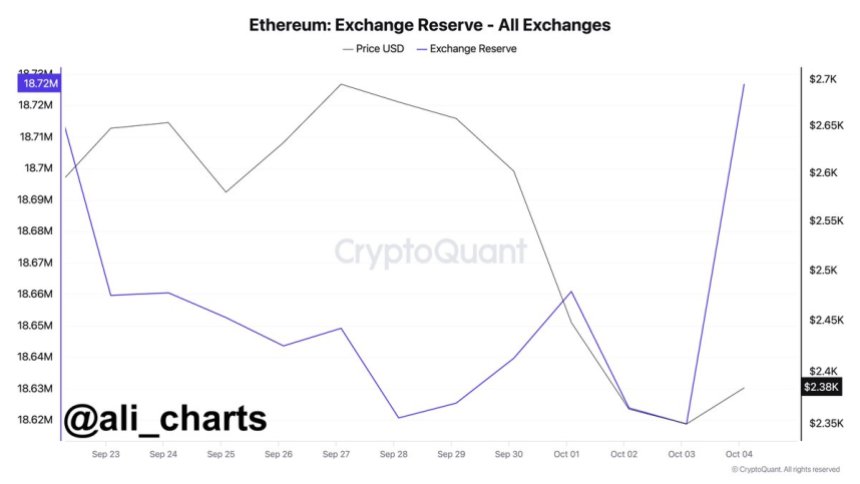

This isn’t an isolated incident. Crypto analyst Ali Martinez reported that a whopping $259.2 million worth of ETH was sent to exchanges on October 3rd alone. In the last 24 hours, a staggering 108,000 ETH has been sent to exchanges, which is significantly higher than the previous day.

A Bearish Outlook?

This news has fueled a bearish sentiment in the community. Many are concerned about Ethereum’s performance and fear that the price could face significant selling pressure.

Crypto investor Ted Pillows notes that ETH has been one of the worst-performing cryptos in 2024. Despite the approval of Ethereum spot ETFs, it has “underperformed almost every large cap.” He also pointed out that ETH has been more volatile than Bitcoin, surging alongside it during bull runs but dropping much harder during downturns.

However, Pillows believes that Ethereum could see a “one last flush” to $2,200 before it rebounds. He’s not the only one with this prediction. Trader Crypto General also suggests that ETH could retest the $4,000 mark by next month, but warns that if the price breaks a key trendline, it could easily drop to $2,100.

Will ETH Bounce Back?

Other market watchers are more optimistic. They believe that Ethereum needs to reclaim the $2,400 resistance level to see a potential bounce toward $2,800. Analyst Daan Crypto Trades considers reclaiming the $2,850 level as a key indicator of a trend reversal.

At the time of writing, ETH has seen a positive price jump, currently trading at $2,431. This represents a 4.3% surge in the daily timeframe.

Whether ETH will bounce back or continue its downward trend remains to be seen. But with so much uncertainty in the market, it’s a story worth watching.