Ethereum (ETH) Outflows Signal Potential Decline in Selling Pressure

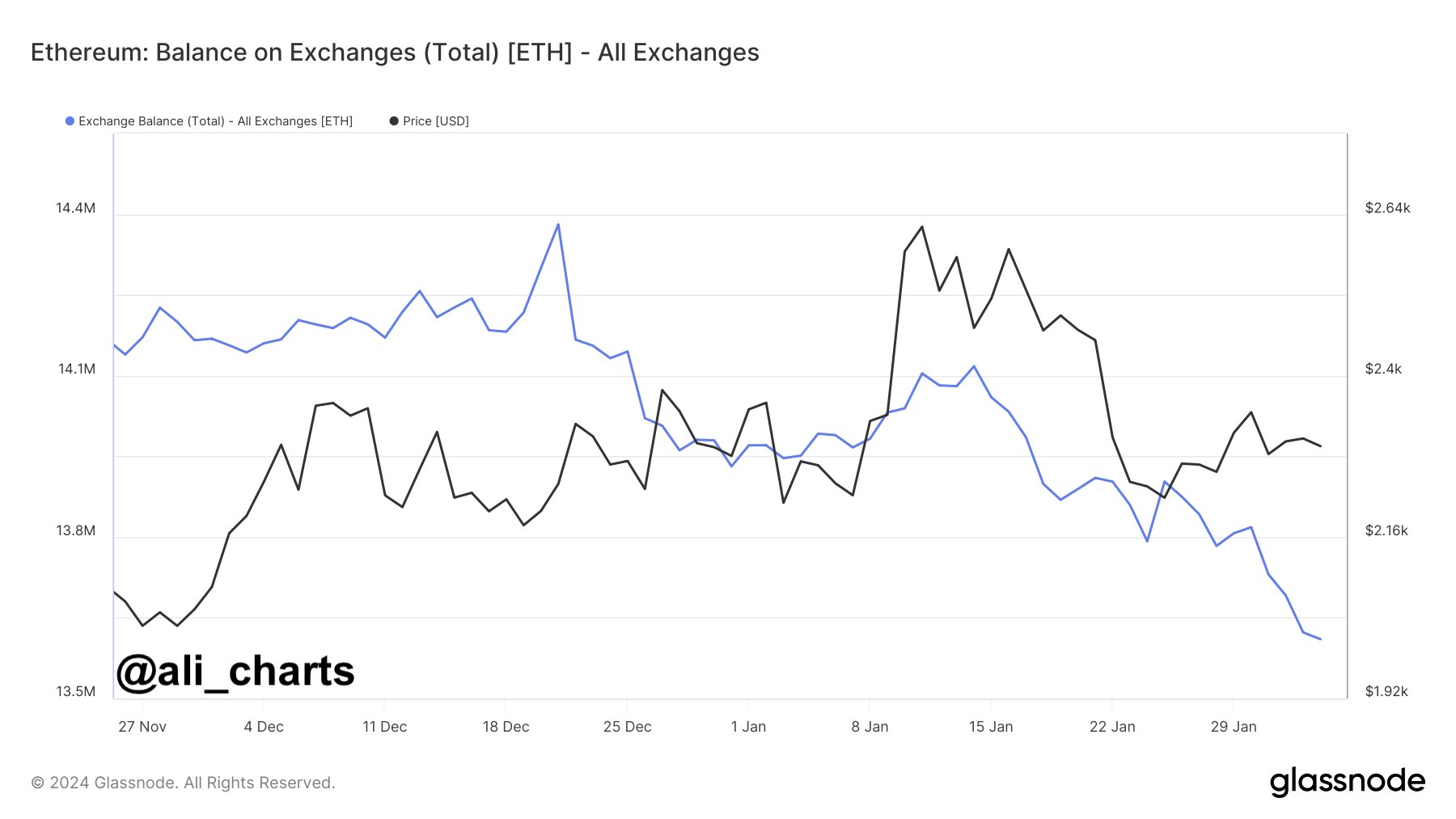

Cryptocurrency analyst Ali Martinez observed a significant outflow of Ethereum (ETH) from crypto exchanges, indicating a strong holder sentiment and potentially less selling pressure in the market. In the past three weeks, nearly 510,000 ETH, worth approximately $1.22 billion, exited known crypto exchange wallets.

Ethereum Exchange Holdings Decline

Based on data from crypto analytics platform Glassnode, the amount of Ethereum on exchanges reached a recent high of just under 14.4 million in December but fell to less than 13.65 million in late January. Ethereum is currently trading at $2,316.

Cardano (ADA) Poised for Market Expansion

Martinez also analyzed Cardano (ADA), the ninth-largest crypto asset by market cap. He suggests that if history repeats itself and Cardano mimics its late 2020 price action, ADA is likely to start its next market expansion in the coming months. Currently trading at $0.496, ADA may remain in a consolidation phase until April 2024, setting the stage for its next bull rally.

Dogecoin (DOGE) Trading in Tight Range

Martinez also commented on Dogecoin (DOGE), the top meme crypto asset. According to him, DOGE appears to be trading in a tight range on the four-hour chart based on the Bollinger Bands indicator. This suggests an impending spike in DOGE price volatility, although the analyst did not specify his directional bias. Dogecoin is currently trading at $0.0783.

Stay Informed with FastPayCrypto

To stay updated on the latest news and insights in the cryptocurrency market, subscribe to FastPayCrypto’s email alerts and follow them on social media platforms like Twitter, Facebook, and Telegram.