Ethereum’s price dipped slightly last week, following the trend of other altcoins. But there’s some interesting activity happening on the network itself.

High Network Fees: A DeFi Boom?

Ethereum network fees jumped 18% last week, hitting a nine-month high of $67 million. Analysts say this is likely due to a combination of factors: Bitcoin’s price drop and a huge increase in activity within the Ethereum DeFi (decentralized finance) ecosystem.

DeFi Lending Takes Off

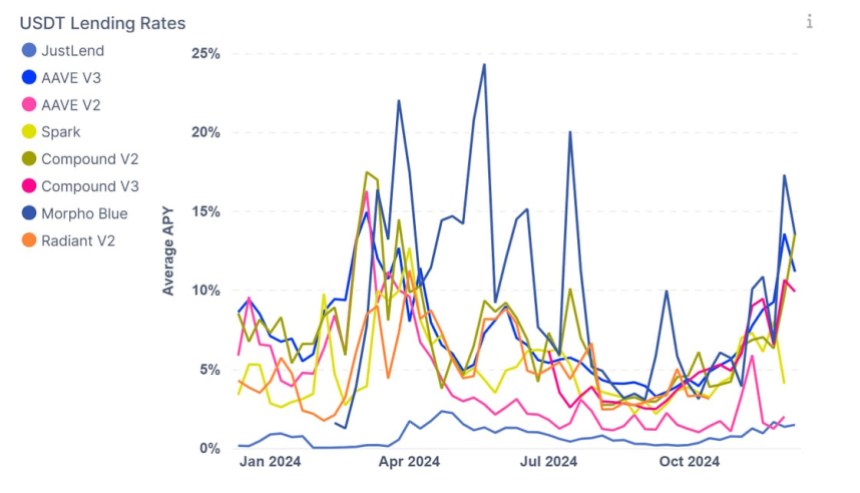

The DeFi lending market is booming. Traders are using wrapped versions of Bitcoin (WBTC) and Ethereum (WETH) to borrow stablecoins. This lets them use their crypto as collateral while still holding onto their Bitcoin and Ethereum. The demand is driving interest rates sky-high – over 10% on average, with some platforms hitting 40%! This reminds some analysts of the peak activity seen during the 2022 bull market. Aave, a major DeFi platform, saw a massive $500 million influx of funds last week.

The Good and the Bad of High Fees

While high network activity is generally a positive sign, showing strong interest in Ethereum, the increased fees are a problem for smaller users. Only those who can benefit from the high interest rates in DeFi lending will really see the upside.

Ethereum Price: Current Status

Currently, Ethereum is trading around $3,914. It’s up significantly over the past month, but it’s struggling to break through the $4,000 resistance level. If it does, a surge to $4,900 is possible. Ethereum remains the second-largest cryptocurrency, holding a substantial market share.