Ethereum’s price soared 8% last week, hitting $3600. But surprisingly, Ethereum Spot ETFs saw a $38.2 million outflow – ending a five-week winning streak.

A Mixed Bag for Ethereum ETFs

This downturn happened even as Bitcoin ETFs saw positive inflows. It’s a bit of a puzzle, especially considering the excitement around Ethereum ETFs after the November US elections. Back then, with the expectation of a crypto-friendly government, ETFs saw huge inflows, totaling $2.11 billion, despite a 23% drop in ETH’s price.

The Big Losers and Winners

The biggest losers this week were:

- Bitwise’s ETHE: -$56.11 million

- Grayscale’s ETHE: -$51.62 million

- Franklin Tempton’s EZET: -$3.11 million

On the flip side, some ETFs saw inflows:

- Fidelity’s FETH: +$38.42 million

- BlackRock’s ETHA: +$33.88 million

- Grayscale’s ETH: +$1.10 million

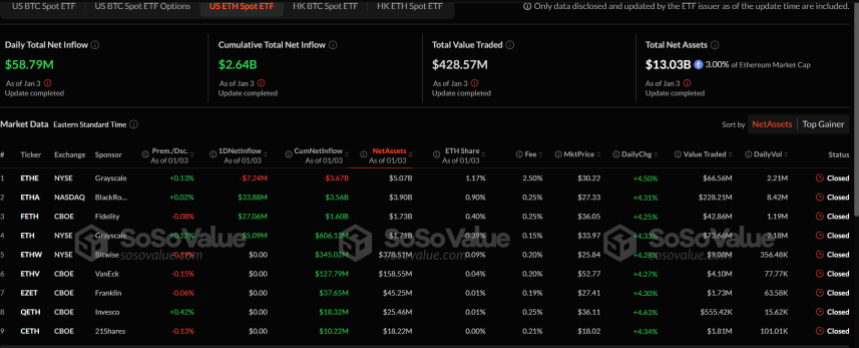

BlackRock’s ETHA is still the most popular Ethereum ETF with $3.56 billion in total inflows, but Grayscale’s ETHE holds the largest market share with $5.07 billion in net assets. Overall, Ethereum Spot ETFs now manage $13.03 billion – a significant 3% of Ethereum’s total market cap.

Bitcoin ETFs Still Strong

While Ethereum ETFs stumbled, Bitcoin ETFs had a great week, pulling in $245 million in inflows, largely thanks to a massive $908.1 million investment on Friday. Bitcoin ETFs now hold $111.46 billion in assets, with BlackRock’s IBIT dominating the market (48.68%).

The Current Market

As of now, Bitcoin is trading around $97,638, and Ethereum is at roughly $3,660.