Despite the recent approval of Spot Ethereum ETFs, which are expected to launch next week, Ethereum derivatives volume hasn’t seen a significant jump. This suggests that investors aren’t overly confident about a major price surge for ETH.

Low Confidence in ETH’s Price

Data shows that Ethereum futures contracts are currently trading at a premium of 11%, indicating a lack of bullish sentiment among traders. This is surprising considering the potential for a price rally fueled by the new ETFs.

While some analysts predict ETH could reach $4,000, traders seem hesitant. This could be due to several factors:

- Grayscale’s Outflows: Research suggests that Grayscale’s Spot Ethereum ETF could see daily outflows of $110 million. This could put downward pressure on ETH’s price.

- High Fees: Grayscale’s Ethereum ETF has the highest fees among its competitors, at 2.5%. This could discourage investors, as they can find similar products with lower fees.

A Case for ETH’s Rise

However, some analysts remain optimistic about ETH’s future.

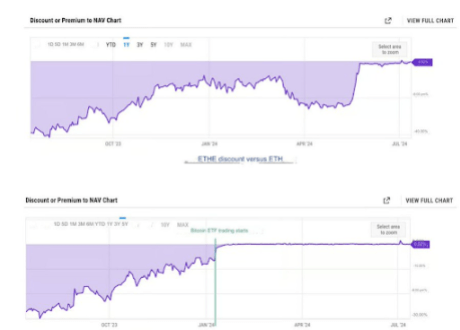

- Narrowing Discount: The discount between Grayscale’s Ethereum Trust (ETHE) and ETH’s price has narrowed significantly since the ETF approval. This suggests that investors who wanted to exit their ETHE positions have already done so.

- Limited Profit-Taking: Unlike Grayscale’s Bitcoin Trust (GBTC), ETHE didn’t start trading immediately after approval. This means that there’s less opportunity for investors to profit from the discount between ETHE and ETH’s price.

While the future of ETH’s price remains uncertain, the launch of Spot Ethereum ETFs is likely to have a significant impact on the market. It’s too early to say whether the hype surrounding these ETFs will translate into a sustained price rally for ETH.