Ethereum’s value has dropped about 18% since March 2024. Despite the current bearish trend, analysts remain optimistic.

Rising Institutional Interest

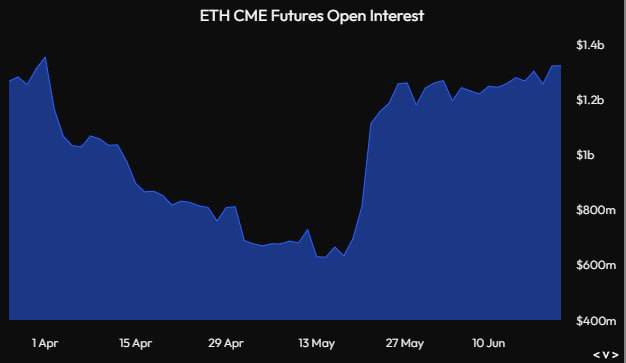

Data from the Chicago Mercantile Exchange (CME) shows a surge in open interest for Ethereum futures. This indicates that institutions are buying up ETH, potentially driving prices higher. This trend is similar to what happened with Bitcoin before the launch of spot Bitcoin ETFs.

Spot Ethereum ETFs: A Potential Catalyst

The launch of spot Ethereum ETFs could further boost prices. Seven applications have been approved by the SEC, and trading could begin by early July 2024. While some analysts believe these ETFs will not be as successful as Bitcoin ETFs, others predict they could attract significant capital.

Technical Analysis

Currently, Ethereum is facing resistance at $3,700. If buyers can push prices above this level, it could lead to a breakout and potential rally towards $5,000.

Conclusion

Despite the current market conditions, analysts remain bullish on Ethereum. Rising institutional interest and the potential for spot ETFs could drive prices higher. However, the success of these ETFs remains uncertain.