Crypto analyst Michaël van de Poppe thinks Ethereum (ETH) might be about to take off. He’s looking at the recent trend of money flowing into new Ethereum exchange-traded funds (ETFs).

ETFs Are Key

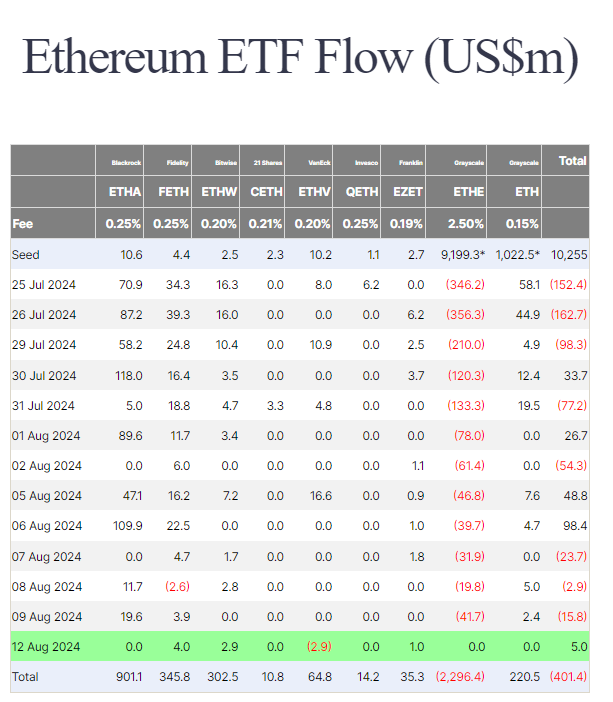

Van de Poppe says that for the first time, there were no outflows from Ethereum ETFs on Monday. He believes that if this week sees more than $50 million flowing into these ETFs, it could signal a strong upward trend for Ethereum.

He also points out that Ethereum ETFs have been following a similar pattern to Bitcoin (BTC) ETFs. They’ve both seen a couple of weeks of downward movement, but now they’re starting to see a slow climb with more money coming in.

Staking vs. ETFs

Van de Poppe is also interested in how much Ethereum is being staked compared to how much is going into ETFs.

“Currently, 30% of Ethereum is staked,” he says. “But there’s going to be a big increase in supply next year, around $170 million. In the last 10 days, $130 million has flowed into ETFs. If this keeps going, it could have a bigger impact on Ethereum’s price than Bitcoin.”

What This Means for Ethereum

Overall, van de Poppe is optimistic about Ethereum’s future. He believes that the increasing popularity of Ethereum ETFs could lead to a significant price increase.

Disclaimer: This information is for educational purposes only and should not be considered investment advice. Always do your own research before making any investment decisions.

/p>