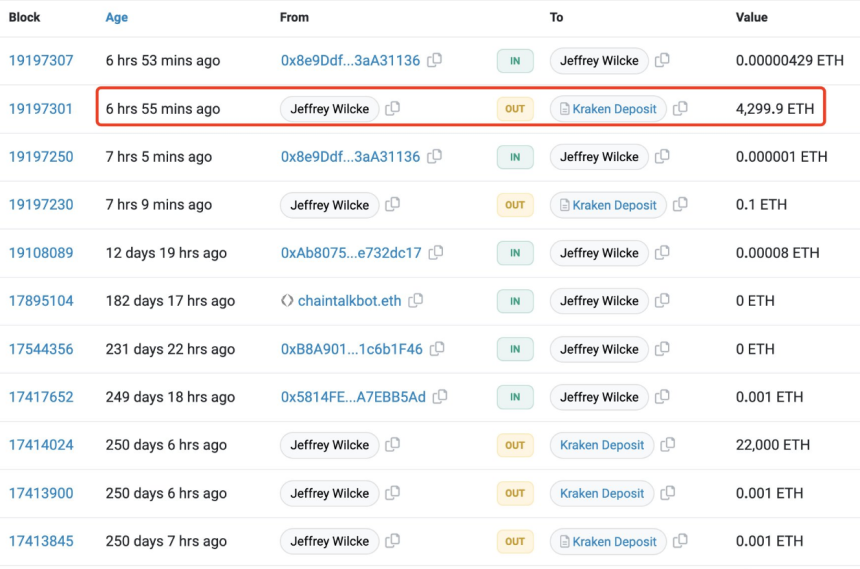

Significant Deposit and Market Impact

In a recent development, Ethereum co-founder Jeffrey Wilcke’s wallet made a notable deposit of 4,300 ETH to a cryptocurrency exchange, totaling 22,000 ETH, valued at approximately $41.1 million. This deposit has injected renewed interest and excitement into the market, despite the overall trend of Ethereum’s netflow remaining unaffected.

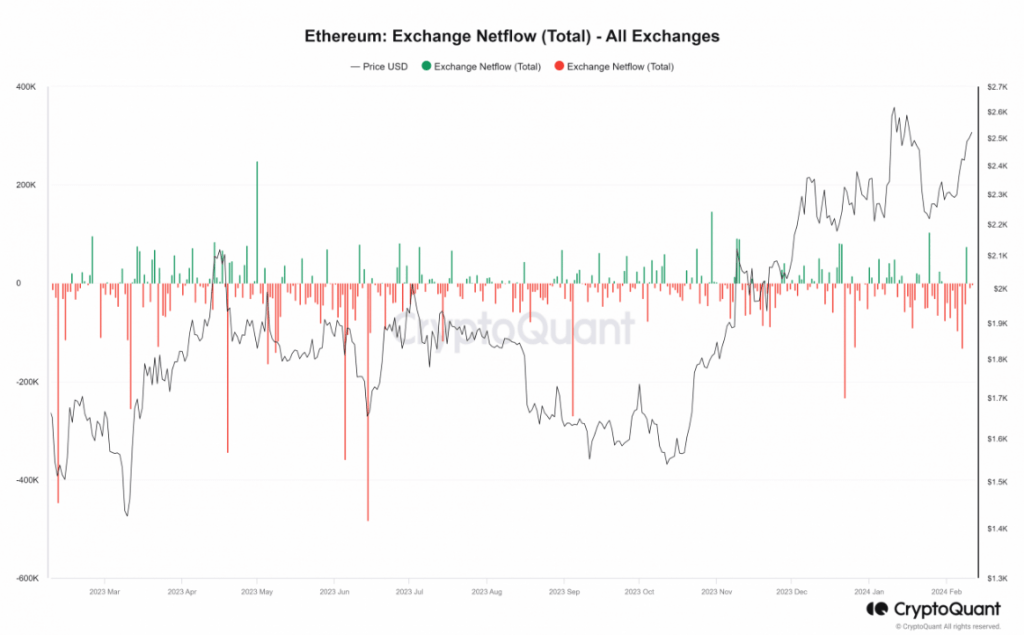

Netflow Analysis and Price Movements

An analysis of the Netflow metric on CryptoQuant shows a continued outflow of ETH from exchanges, with over 9,800 ETH leaving on February 10th. However, the previous day witnessed a significant inflow of over 75,000 ETH. Amid these market movements, Ethereum’s price has been on an upward trajectory over the past three days, trading at over $2,500, indicating a strong positive trend.

Bullish Momentum and Technical Indicators

Technical indicators further validate the bullish sentiment, with the RSI crossing the 60 mark and moving towards the overbought zone, while the price remains above the yellow line, acting as a support level. Ethereum’s recent performance has surpassed even Bitcoin, signaling a robust bullish trend.

Speculation and Anticipation

Speculation is building about a potential climb to $3,000 and even $5,000, fueled by rumors of an upcoming upgrade called “Dencun” next week. However, information about this upgrade is limited, and further research is required to verify its impact on Ethereum’s potential price surge.

Caution and Informed Decision-Making

Investors and enthusiasts are advised to exercise caution and stay informed by tracking official Ethereum community channels, developer blogs, and reputable cryptocurrency news sources. Wilcke’s recent deposit, combined with Ethereum’s positive trend and the anticipation surrounding the rumored Dencun upgrade, has created an atmosphere of excitement and speculation within the cryptocurrency market. With ETH surpassing Bitcoin and eyeing new all-time highs, the future of Ethereum holds immense potential for investors and traders alike.