Bullish Sentiment in Options Market

Ethereum traders are feeling optimistic, as evidenced by the recent surge in call option purchases. Call options give traders the right to buy Ethereum at a set price within a certain time frame. The fact that call options are more expensive than put options (which give the right to sell) across all expiries suggests that traders are betting on Ethereum’s price going up.

Market Indicators Point to Bullish Outlook

Luuk Strijers, CEO of Deribit, noted that the “put minus call skew is negative across all expiries,” indicating a bullish signal. Additionally, the basis (the premium of futures prices over spot prices) has increased to around 14%, further supporting the bullish outlook.

Spot ETF Approvals Fuel Optimism

The potential approval of spot Ethereum exchange-traded funds (ETFs) has boosted market sentiment. Deribit has experienced record trading volumes, with over $12.5 billion traded in the last 24 hours.

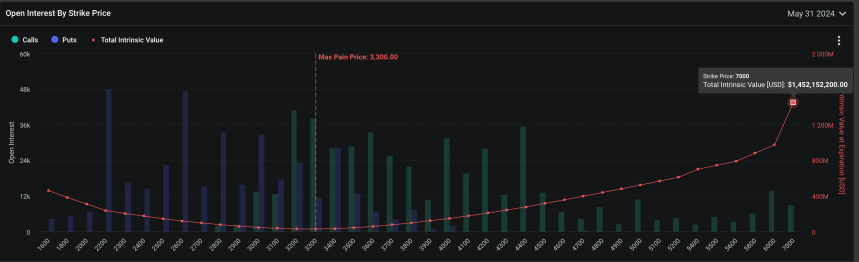

Call Options Expire with High Strike Prices

Over $480,000 in call options will expire by the end of this month, with a strike price as high as $7,000. This indicates that many traders are expecting Ethereum’s price to continue rising.

Price Performance and Forecast

Ethereum is currently experiencing a slight retracement, but has maintained a strong uptrend over the past week. Analysts predict a potential pullback at around $4,000 before a surge to new all-time highs. The approval of spot ETFs could further fuel this bullish momentum.