Ethereum (ETH) has been on a roll, exciting investors but also raising concerns.

Positive Factors

- ETF Approval: The potential approval of an Ethereum ETF could bring in billions of dollars from institutional investors.

- Bitcoin Halving: The upcoming Bitcoin halving could boost the entire crypto market, including Ethereum.

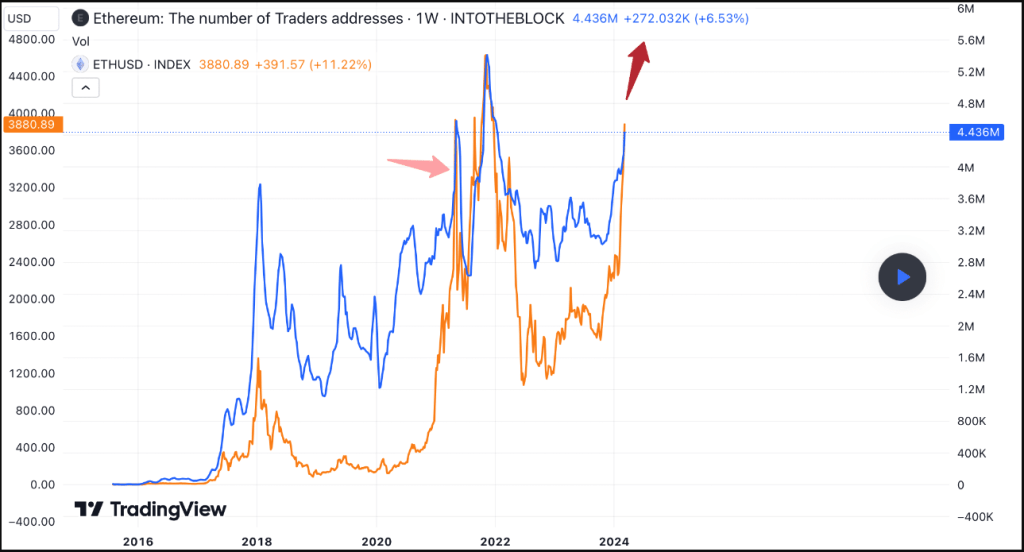

- Increased Short-Term Holders: Data shows a surge in the number of people holding Ethereum for a short period, which has historically been a sign of bull markets.

Cautionary Signals

- Overbought Indicators:

Technical indicators like RSI and CMF suggest that Ethereum’s price may be stretched too thin and due for a pullback.

- Mixed Investor Sentiment: Buying pressure is strong in the US, but selling activity is evident in Korea, indicating differing market dynamics and investor preferences.

Balancing Act

Ethereum’s future is uncertain. Positive factors point to a potential bull rally, while cautionary signals suggest a possible price correction. It’s too early to tell if Ethereum will continue its momentum or face a reality check.