Ethereum (ETH) is giving off mixed signals. While some analysts see a potential price surge, others are worried about rising ETH held on cryptocurrency exchanges.

Is Ethereum Hitting Bottom?

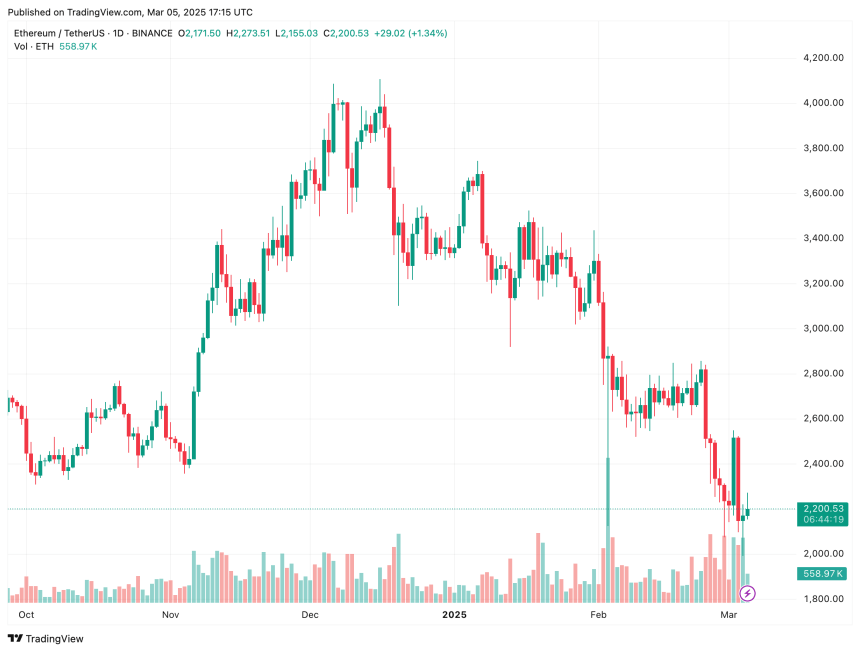

ETH has taken a dive recently, dropping about 20% in two weeks. This wiped out a huge chunk of its market value. Despite this, some analysts are optimistic.

Bullish Indicators

Several analysts are pointing to bullish indicators suggesting a possible price turnaround:

-

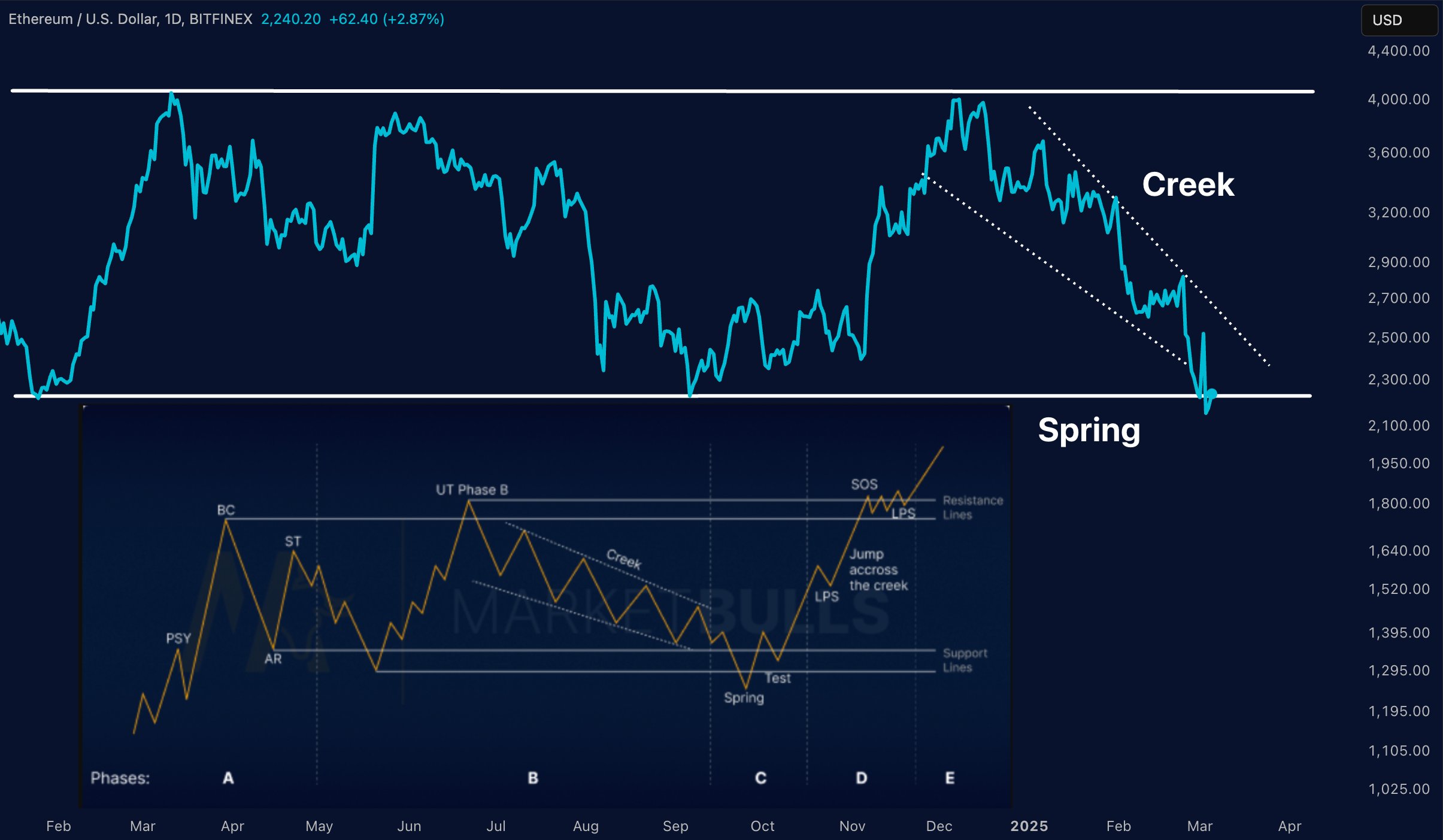

Wyckoff Reaccumulation: One analyst, Merlijn The Trader, sees ETH following a pattern called the Wyckoff Reaccumulation. This suggests ETH might be accumulating before a price increase. They even think a “spring phase” has been triggered, which could mean a brief dip is actually a trap for sellers, leading to a rally towards $4,000.

-

Bullish Divergence:

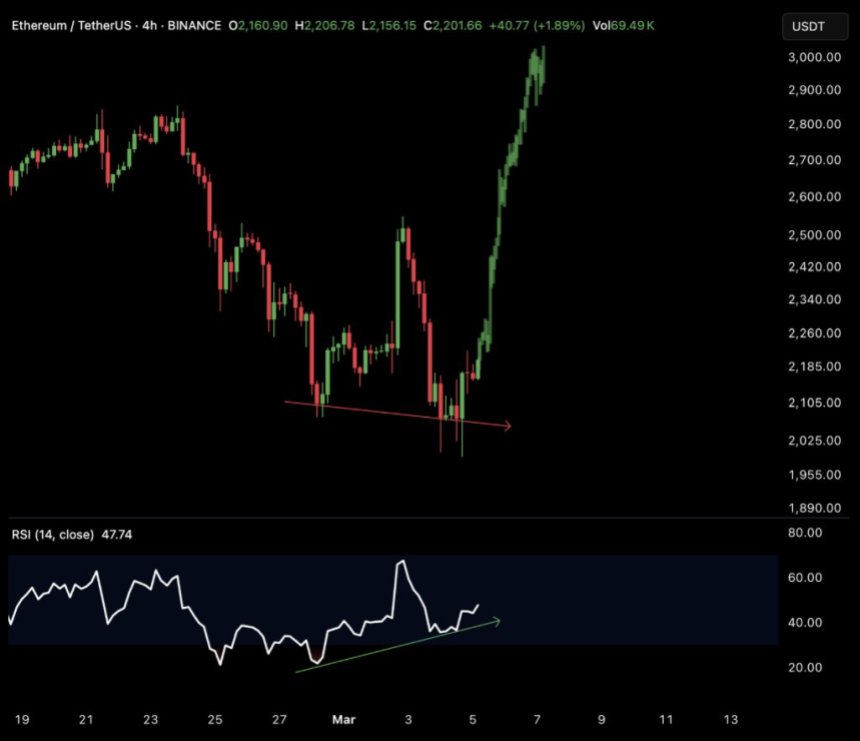

Merlijn also spotted a bullish divergence on the 4-hour chart, suggesting an upcoming move towards $2,700 before going even higher.

Merlijn also spotted a bullish divergence on the 4-hour chart, suggesting an upcoming move towards $2,700 before going even higher. -

Whale Activity:

Another analyst, Ted, highlighted a large ETH purchase by a “whale” (someone holding a massive amount of ETH). This significant buy adds to the bullish sentiment.

Another analyst, Ted, highlighted a large ETH purchase by a “whale” (someone holding a massive amount of ETH). This significant buy adds to the bullish sentiment.

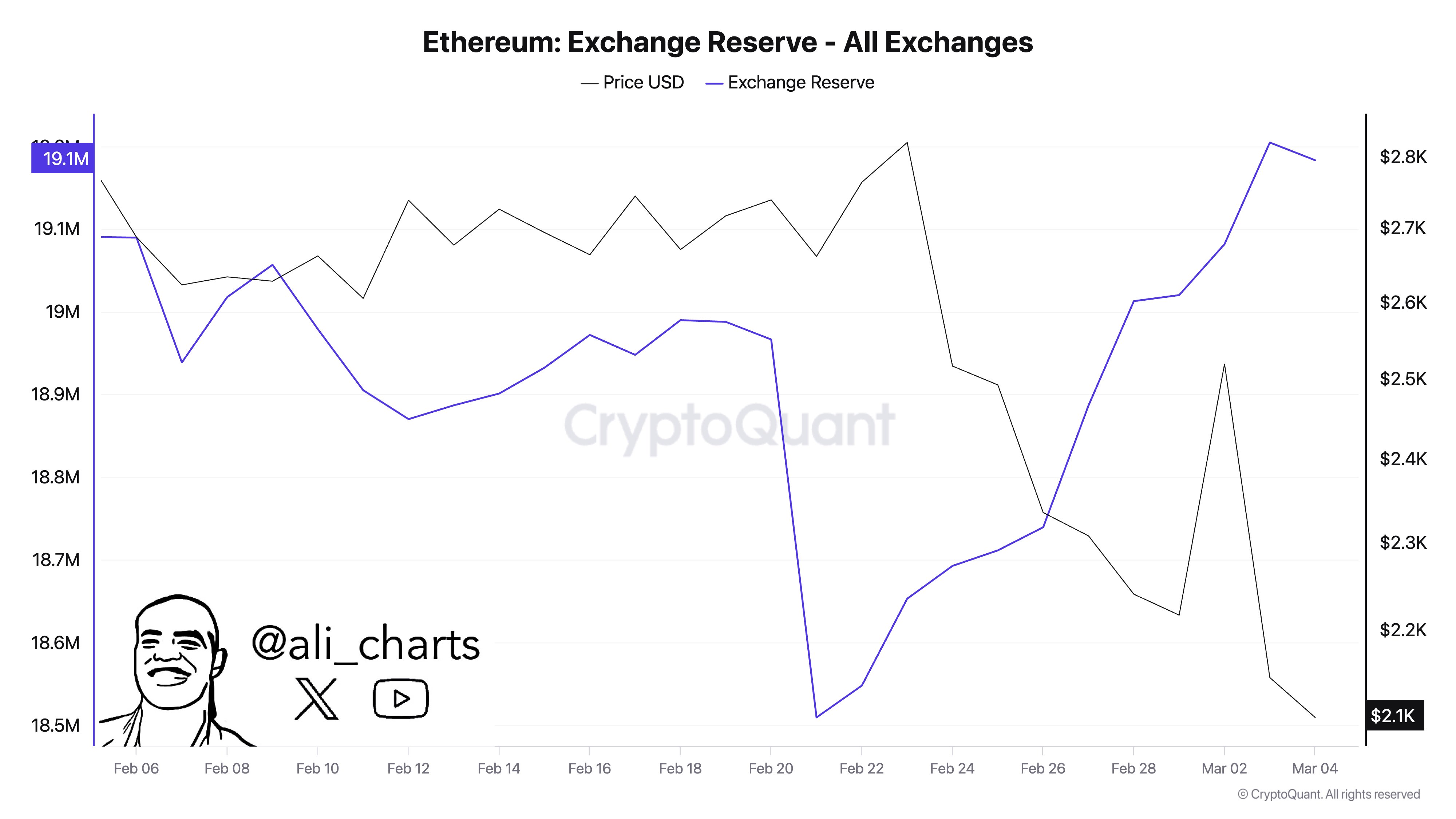

The Bearish Counterpoint: Exchange Reserves

But not everyone is cheering. Analyst Ali Martinez points out that the amount of ETH held on exchanges is increasing. This could mean more ETH is available for selling, potentially putting downward pressure on the price. A recent report also suggests further price drops are possible, even though ETH’s Relative Strength Index (RSI) is at a multi-year low. The overall sentiment around ETH has been bearish for a while now, compared to other cryptos like Bitcoin. However, this extreme bearishness could ironically be a sign that a price rally is coming.

The Current Situation

Currently, ETH is trading around $2,200, up slightly in the last 24 hours. It’s a battle between bullish signals and the concern over increasing exchange reserves. The future price movement remains uncertain.