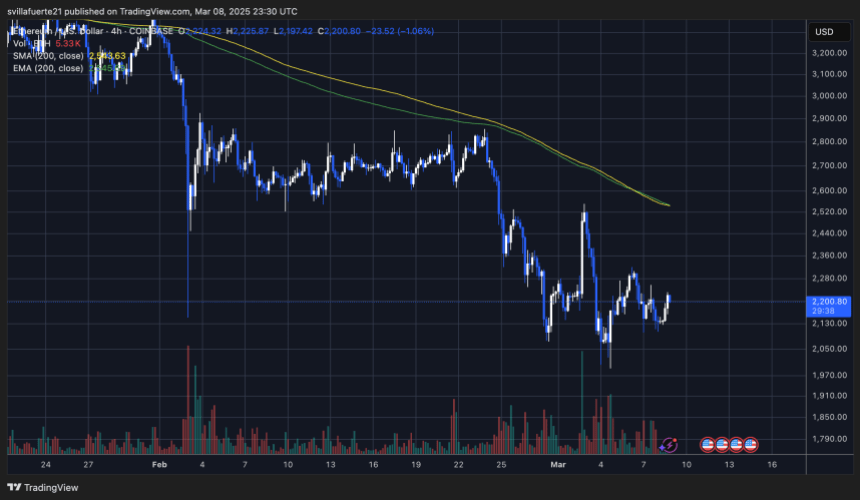

Ethereum (ETH) has been stuck around $2,200, with buyers struggling to push the price higher despite several attempts. The overall feeling in the market is bearish, and ETH keeps facing selling pressure even after the US announced its Strategic Bitcoin Reserve – something many thought would boost crypto confidence.

A Crucial Week for Ethereum

Analysts think the next week is make-or-break for ETH in the short term. If buyers can hold onto key support levels, Ethereum might regain some momentum. But if it fails, we could see the price drop further.

Analyst Carl Runefelt pointed out on X that Ethereum is breaking out of a pattern that often signals a price surge. If this plays out, ETH could hit higher resistance levels and climb back above $2,500. However, we need confirmation – the market is still super volatile.

Ethereum Bulls Hoping for a Comeback

Ethereum has taken a big hit, losing over 50% of its value since late December. This caused a lot of fear and panic selling. ETH, once a star performer, is struggling to recover, making many question if the long-awaited altcoin boom will happen this year. Most altcoins are in the same boat, keeping investors on edge.

Despite the negativity, there’s still hope. Ethereum is nearing some key technical levels that will decide its next move. Runefelt’s analysis shows ETH breaking above a descending triangle, a pattern that often means a trend reversal. But it’s important to remember that many past breakouts have been fake-outs, leading to further price drops.

For a real bullish breakout, ETH needs to push past and close above $2,300. This is a major resistance level, and turning it into support would show strong buying power, potentially leading to a push towards $2,500 and beyond. Until then, another drop is possible if sellers take control. Everyone’s watching closely to see if ETH can hold this breakout or get rejected again.

Key Levels to Watch

Ethereum is currently trading above the $2,000 support level – a crucial line in the sand for buyers hoping for a good year. Losing this level could trigger a bigger drop and strengthen the bearish sentiment. But buyers have struggled to push the price higher, leaving investors frustrated.

The price action has been jumpy and uncertain, with every breakout attempt quickly met with selling. This has kept ETH in a tight range, preventing a clear change in market sentiment. However, reclaiming $2,300 decisively could be a game-changer. If ETH pushes above and holds this level, it could open the door for a move towards $2,500, making a recovery rally more likely. Until then, traders will remain cautious.