Ethereum’s price action has been a rollercoaster lately. Let’s break down what’s happening.

A Crucial Price Point

Ethereum briefly surged past the $2,000 mark – a psychologically important level – but couldn’t hold on. Analysts agree that a sustained stay above $2,000 is key for a real recovery. The crypto has lost a significant chunk of its value since December, falling from around $4,100 to lows near $1,750. So, $2,000 is a major battleground.

Is This a Bullish Signal?

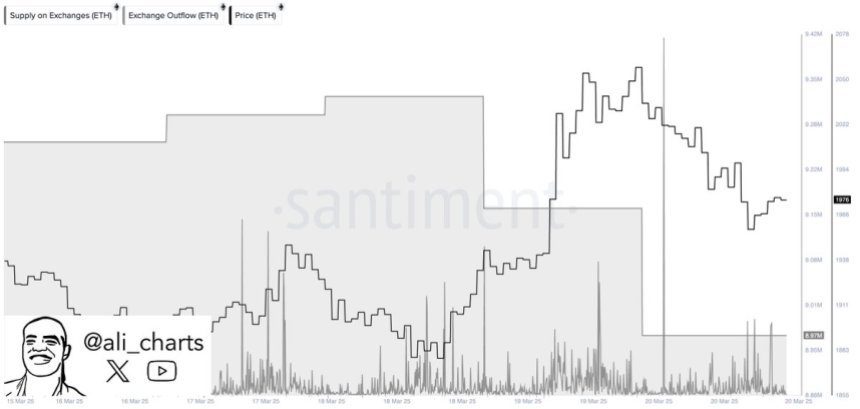

Interestingly, a lot of Ethereum is moving off exchanges. According to data, over 360,000 ETH was withdrawn from centralized exchanges in just 48 hours. This is often seen as a positive sign. It suggests that big investors are moving their coins to their own wallets, perhaps betting on higher prices in the future.

Macroeconomic Headwinds

The overall economic picture is still pretty uncertain. Trade tensions, inflation worries, and government policy changes are all creating volatility in both the crypto and traditional markets. This makes it tough to predict what will happen next.

The $2,000 Hurdle

Ethereum is currently trading just below $2,000. Breaking through and holding above this level would be a huge boost for the bulls (those betting on higher prices). If it fails to do so, we could see further price drops. The next few days are crucial. A strong move above $2,000, followed by a move above $2,150 and $2,300, would signal a potential turnaround. Failure to break through could mean a drop back towards $1,850 or even $1,750. The market is definitely watching closely.