Big Dogecoin investors, often called “whales,” have significantly reduced their activity. This could be a bad sign for the cryptocurrency’s price.

Whale Activity Plummets

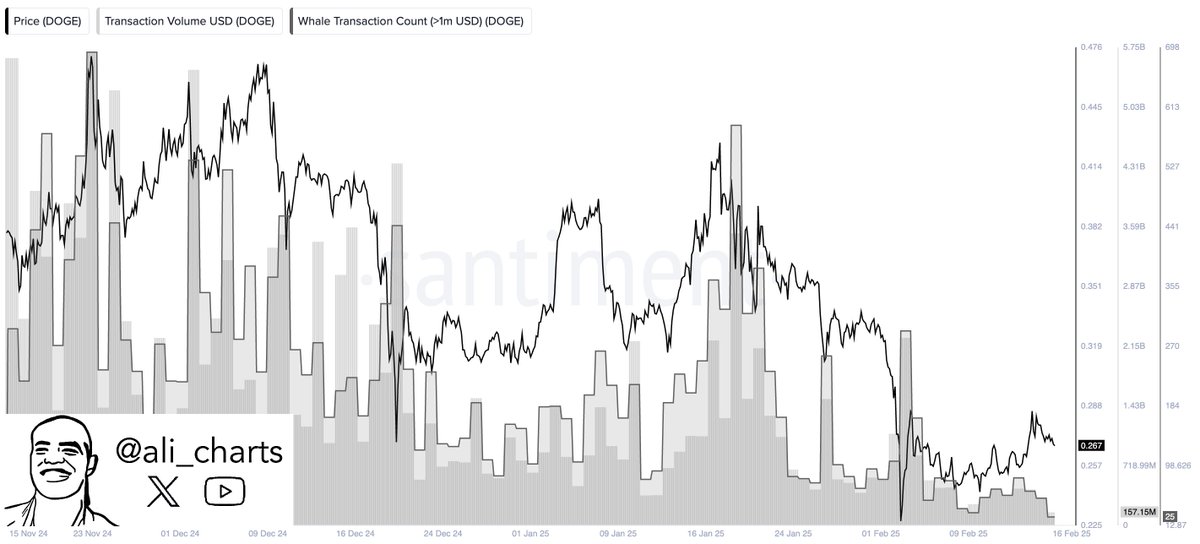

Data shows a massive drop in large Dogecoin transactions – those worth over $1 million. This is a key indicator of whale activity, tracked by analytics firm Santiment. Since mid-November, the number of these transactions has plummeted by almost 88%! That’s a huge decrease from the peak activity seen earlier in November. Currently, there are only about 25 daily transactions from whales.

This drop in whale activity suggests these big investors are less interested in Dogecoin right now. When whales are actively trading, it often indicates confidence in the asset. The opposite is true when their activity slows down.

More Bad News for Dogecoin

The reduced whale activity isn’t the only negative sign. Another indicator, the Market Value to Realized Value (MVRV) Ratio, has also shown a concerning trend. This ratio reflects the profit/loss situation of Dogecoin investors. As the price has fallen, so has investor profitability, leading to a “death cross” with the 200-day moving average. Historically, this death cross has preceded price drops of 26% and 44% in the past.

Current Dogecoin Price

At the time of writing, Dogecoin is trading around $0.264, a slight increase of about 6% over the past week. However, the concerning on-chain data suggests this might be a temporary bounce.

What This Means

The combination of decreased whale activity and negative signals from the MVRV ratio paints a potentially bearish picture for Dogecoin. While the price has seen a recent small increase, the long-term outlook may be uncertain unless whale activity picks up again. It’s definitely something to keep an eye on.