The NYSE is pushing for a Dogecoin ETF. This would be a big deal, giving investors a regulated way to trade Dogecoin through a traditional exchange-traded fund.

NYSE Files for SEC Approval

The New York Stock Exchange (NYSE) just filed paperwork with the Securities and Exchange Commission (SEC) to list a Bitwise Dogecoin ETF. This is a formal request asking the SEC to allow the ETF to trade on the NYSE. Think of it as the next big step in getting this thing approved.

Behind the Scenes: Solid Infrastructure

Bitwise’s proposal isn’t just some fly-by-night operation. Big names like Coinbase Custody (for securing the Dogecoin) and Bank of New York Mellon (BNY Mellon) for handling the financial side are involved. This adds a layer of legitimacy and trust. Importantly, investors won’t directly handle Dogecoin; the ETF uses a system of cash transactions. The fund’s value will track Dogecoin’s price using a reliable daily benchmark.

The Competition is Heating Up

Bitwise isn’t the only company trying to launch a Dogecoin ETF. Grayscale and Rex Shares are also in the running. In fact, the SEC has already acknowledged Grayscale’s application, putting them on a timeline for a decision around mid-October.

Looking Ahead: High Hopes for 2025

Experts are increasingly optimistic that we could see a Dogecoin ETF approved as early as 2025. Prediction markets are showing increased odds, and some analysts even put the chances as high as 75%.

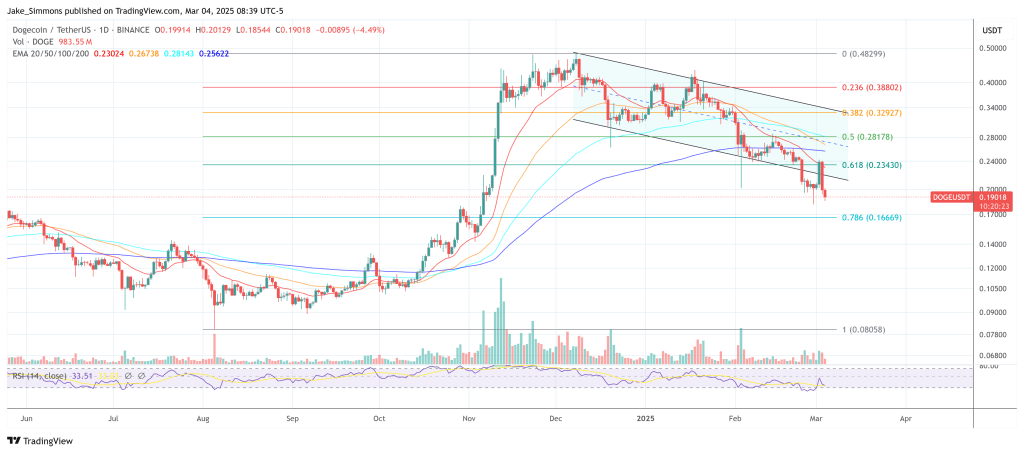

Current Price:

At the time of writing, Dogecoin was trading at $0.19.