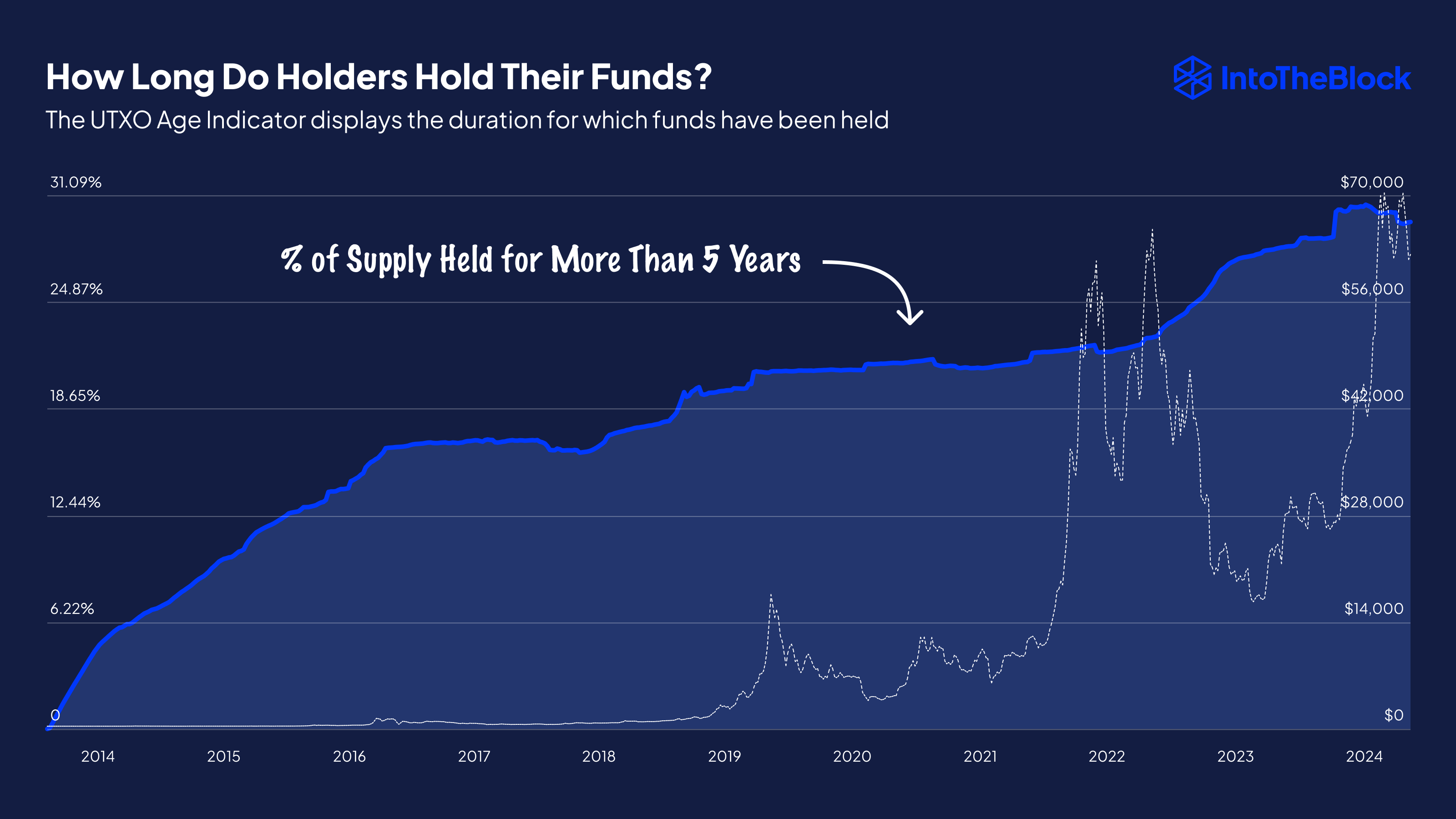

Bitcoin investors are known for their unwavering commitment, and recent data shows just how strong that commitment is. Almost a third of all Bitcoin hasn’t been touched in over five years! This means a huge chunk of the cryptocurrency is held by investors who are incredibly confident in Bitcoin’s future.

The Long-Term Holders (LTHs)

These investors are considered “long-term holders” (LTHs) because they’ve held onto their Bitcoin for a very long time. The longer someone holds onto their coins, the less likely they are to sell them, making LTHs a stable force in the market.

The fact that these Bitcoin haven’t moved in over five years means these LTHs are truly diamond hands, holding onto their investment through thick and thin.

Lost Coins and True Conviction

It’s important to note that not all of this dormant Bitcoin is necessarily being held by investors. Some of it could be lost, either because people forgot about their coins or lost access to their wallets. However, a significant portion of this five-year-old supply is likely held by investors who have unwavering faith in Bitcoin’s long-term potential.

The Price of Bitcoin

While Bitcoin has seen a recent dip in price, the fact that so much of the supply is held by long-term investors suggests that the market is relatively stable. These diamond hands are likely to weather any short-term fluctuations and continue to hold onto their Bitcoin, believing in its future growth.

The fact that almost a third of Bitcoin hasn’t moved in five years is a testament to the strength of the Bitcoin community and the confidence that many investors have in its future. /p>