DeFi expert Arthur Cheong believes the decentralized finance (DeFi) world is experiencing a revival. He’s seeing a surge in interest from investors, fueled by both internal improvements and external economic factors.

Lower Interest Rates, Higher Returns

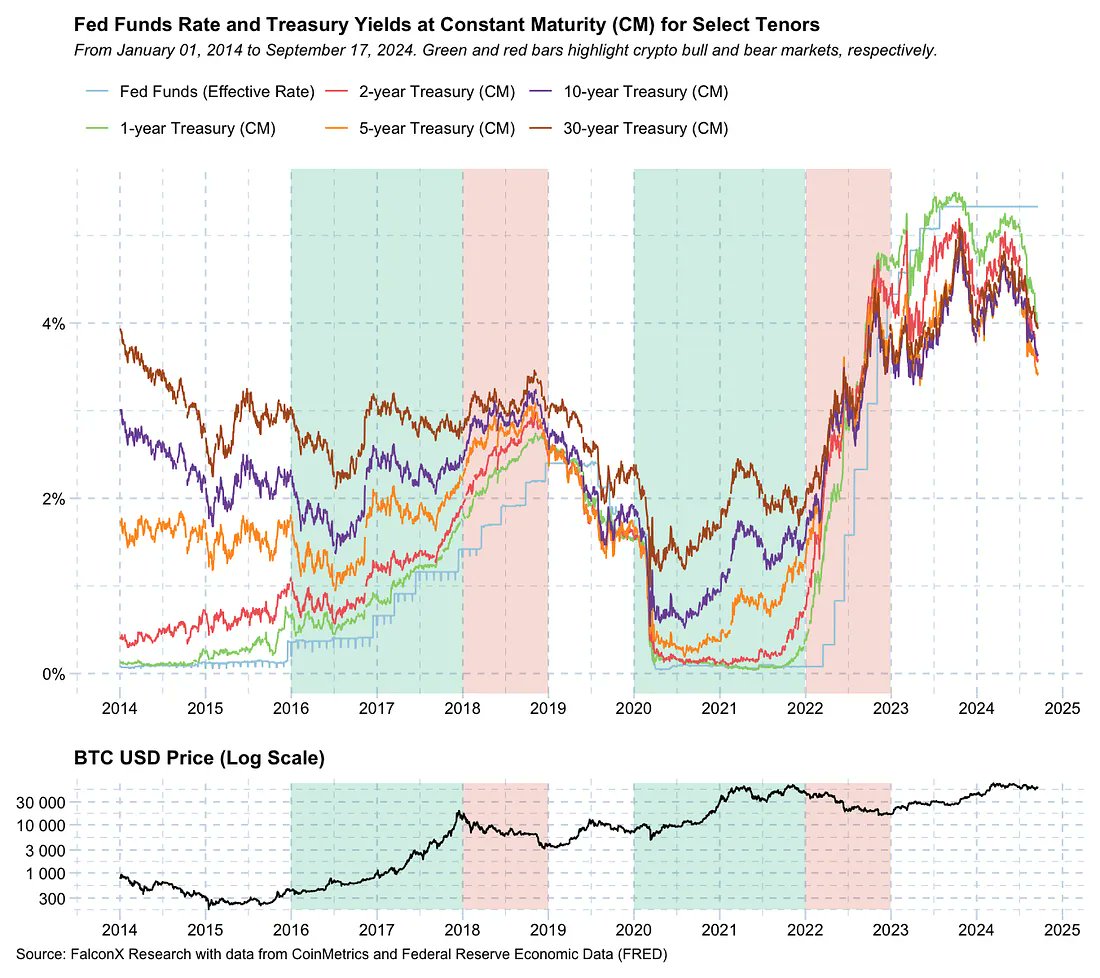

Cheong points to the recent Fed rate cut as a key driver. With traditional savings accounts offering less attractive returns, investors are looking for higher yields. DeFi protocols, with their potential for higher returns, are becoming increasingly appealing.

More Money, More Activity

Lower interest rates also make it cheaper for DeFi users to take out loans. This can lead to increased activity within the DeFi ecosystem as users invest in projects and generate more returns.

Stablecoin Growth

Cheong also predicts that the new interest rate cycle will boost stablecoin growth. With lower borrowing costs, traditional finance (TradFi) funds are more likely to move into DeFi, driving demand for stablecoins.

The Bottom Line

While interest rates may not drop to the near-zero levels seen in the past, even a moderate decrease could significantly impact DeFi. The reduced opportunity cost of investing in DeFi, combined with the potential for higher returns, is creating a favorable environment for a new bull market.