On April 12, the crypto market experienced a sudden drop in prices, leading to massive liquidations.

Massive Liquidations Amidst Price Decline

Bitcoin fell by 4.49% in the last day, hitting a low of $66,052. This triggered a domino effect, with Ethereum and Solana also seeing significant losses.

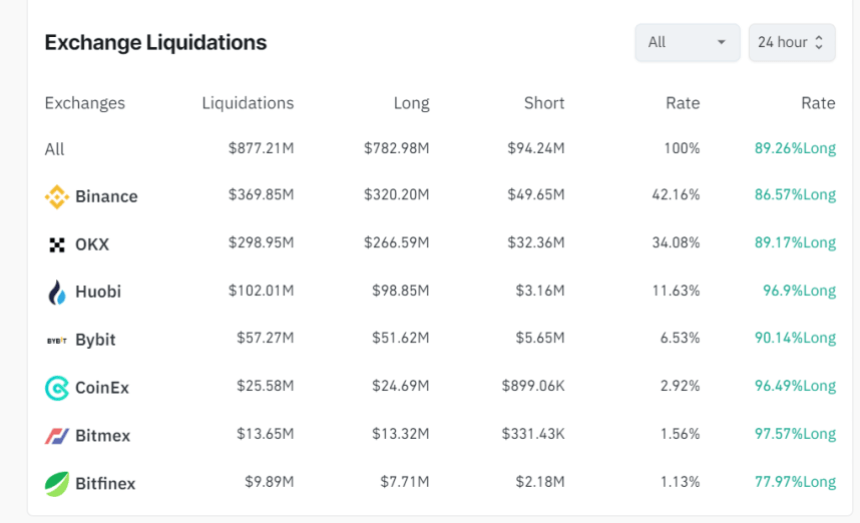

As a result, over 277,000 traders lost their leveraged positions, totaling $877.21 million in liquidations. Notably, $467 million in leverage positions were closed within an hour due to the price decline.

Correlation with US Stock Market

Interestingly, Bitcoin’s price decline coincided with a dip in the US stock market. The S&P 500 index fell by 1.6%, influenced by recent inflation data.

This suggests that the US Federal Reserve may not implement rate cuts soon, which could impact the crypto market as rate cuts encourage investors to seek risky assets like Bitcoin.

Bitcoin Network Growth Despite Price Dip

Despite the price decline, Bitcoin has seen a rise in non-empty wallets on its network ahead of the Halving event on April 19.

Analysts predict that investors will continue to accumulate Bitcoin throughout the Halving event.

At the time of writing, Bitcoin is trading at $66,882, with a 44.80% increase in daily trading volume. However, its price has been declining in recent times, with a 1.33% and 6.20% drop in the last seven and 30 days, respectively.