Cryptocurrency futures markets have been showing some interesting trends lately. While some coins are seeing a decrease in activity, others are heating up. Let’s break it down.

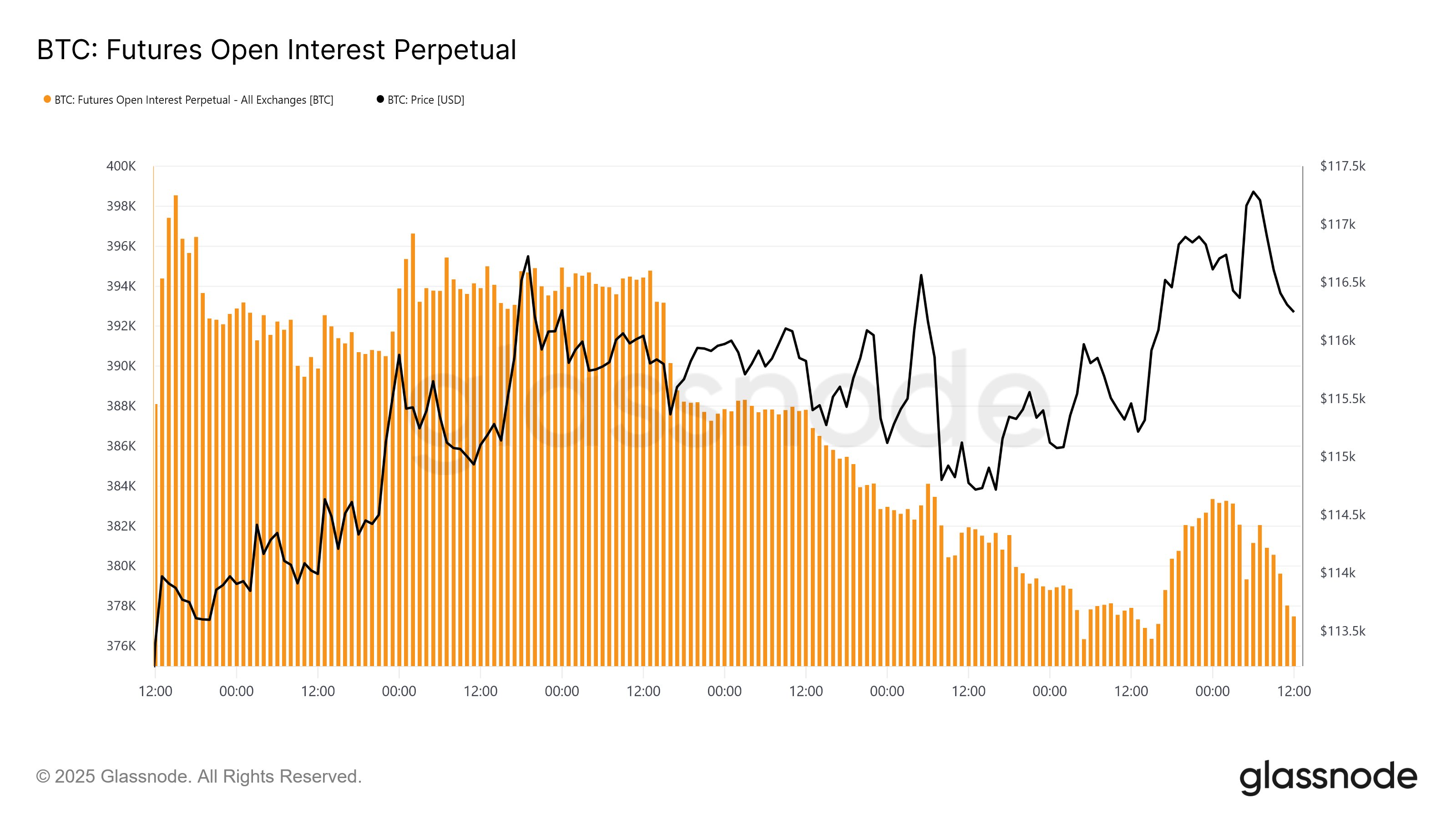

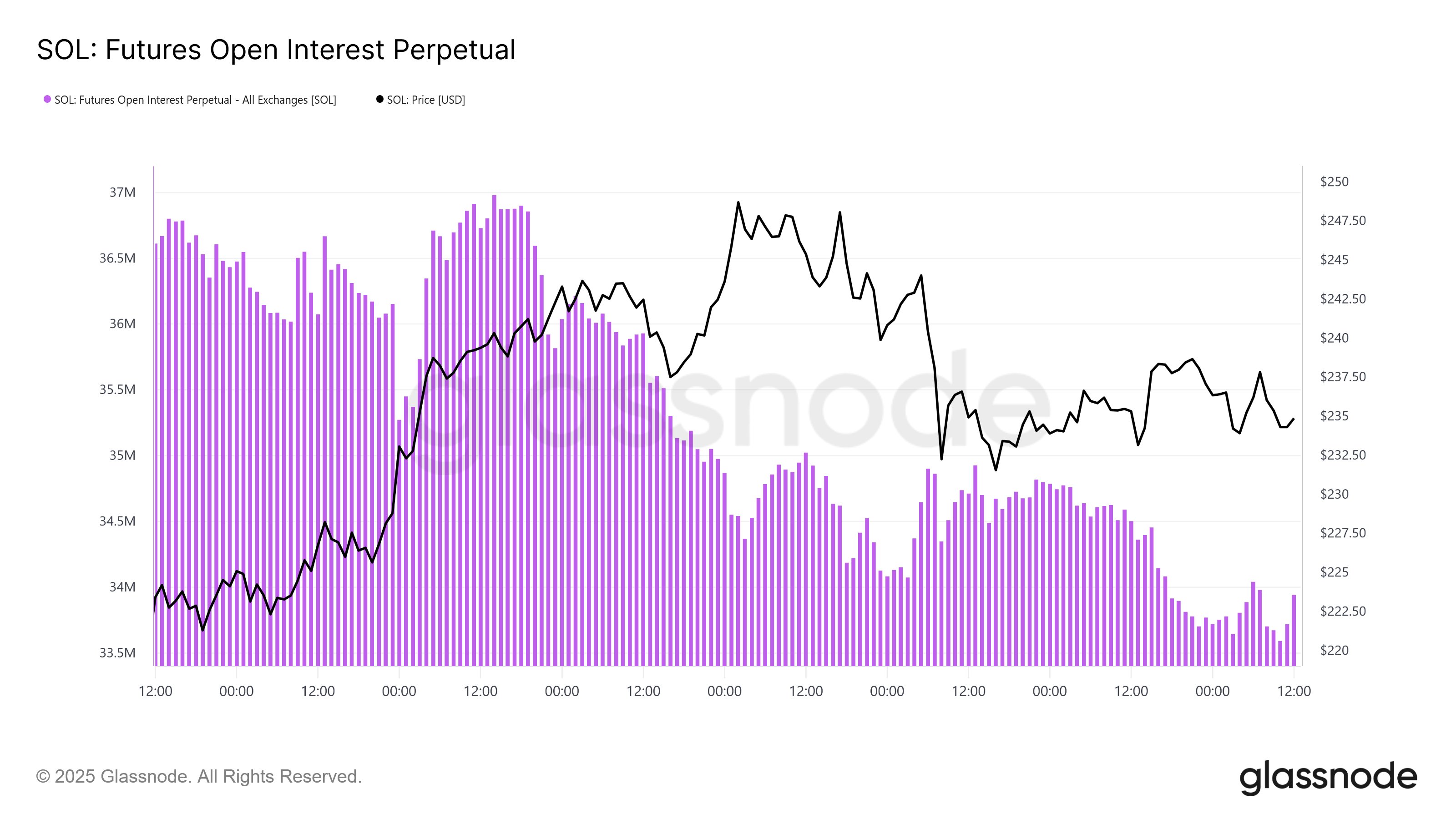

Bitcoin and Solana Cool Off

Bitcoin and Solana have seen a drop in “open interest” – basically, the total number of outstanding futures contracts. This means fewer people are betting on these coins, either by closing their positions or getting forced out. A lower open interest usually means less volatility. Interestingly, this happened even though Bitcoin’s price briefly hit $117,000. Normally, price increases attract more bets, but not this time. Solana showed a similar trend.

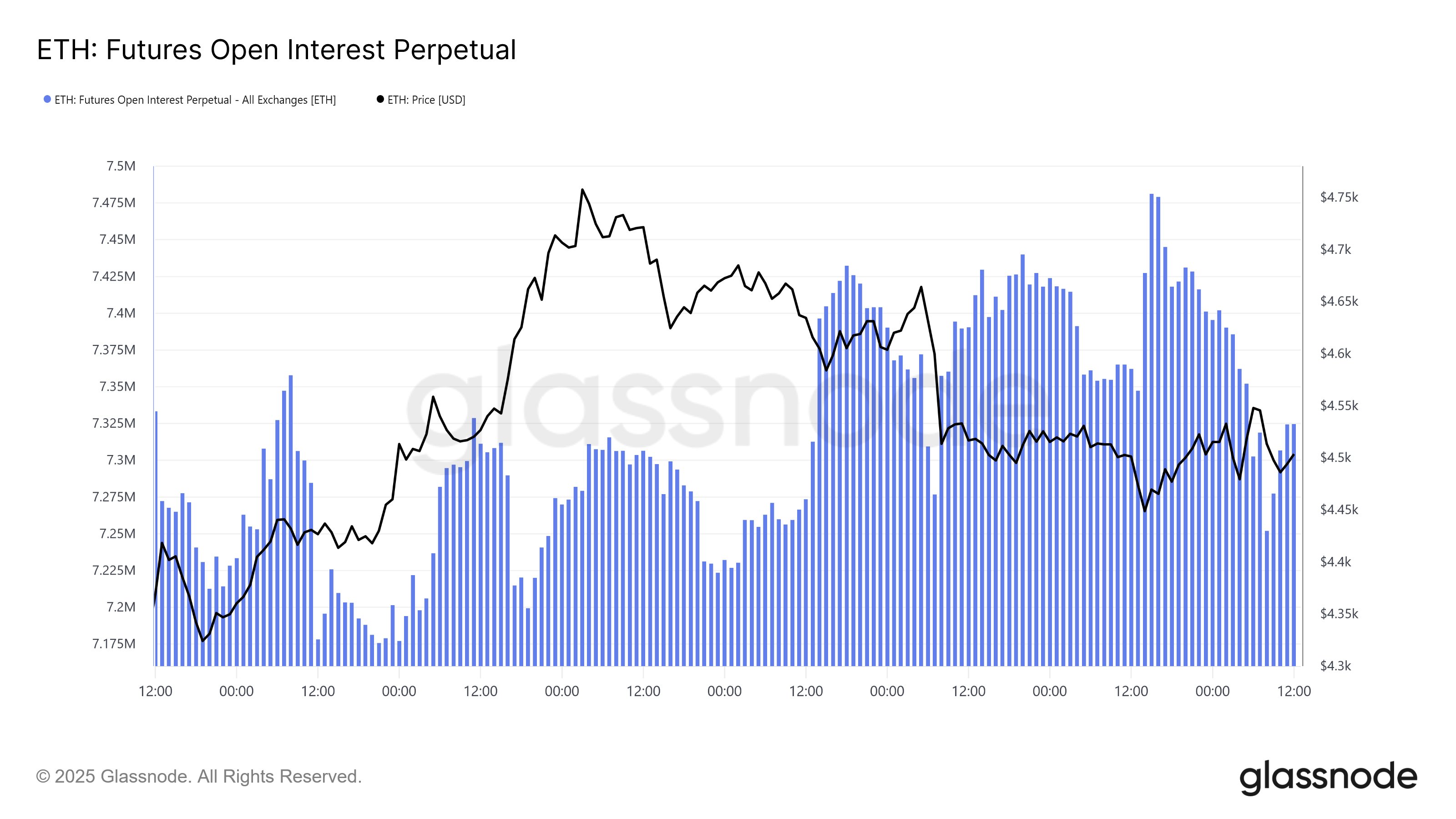

Ethereum and Others Heat Up

The story is different for Ethereum, XRP, and BNB. These coins saw a rise in open interest, meaning more people are placing leveraged bets. This suggests increased investor interest and potentially higher volatility in the near future.

What Does It All Mean?

The crypto market is showing a split. Bitcoin and Solana are experiencing less speculative activity despite price increases, while Ethereum, XRP, and BNB are seeing a surge in activity. This divergence might mean Ethereum and the others could be more volatile than Bitcoin and Solana in the coming days.

Bitcoin’s Recent Price Action

Bitcoin briefly touched $117,900 but has since pulled back slightly to around $117,000.