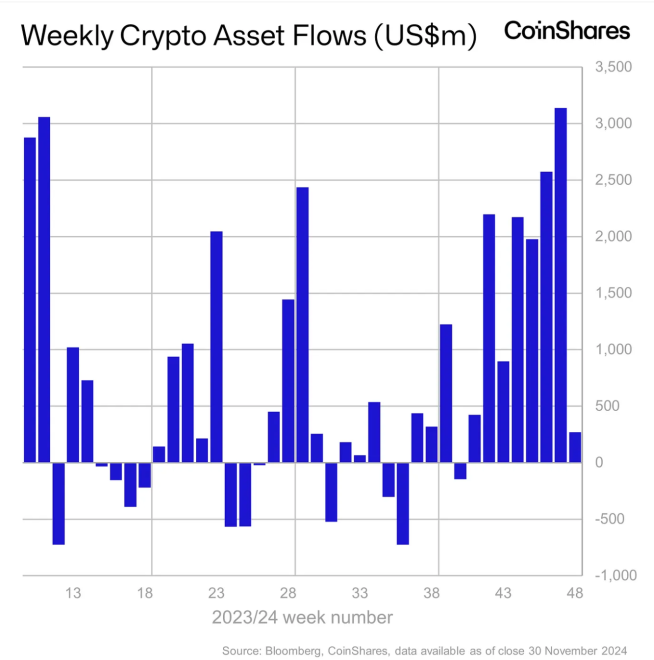

Last week was a big one for crypto investments, with a whopping $270 million flowing into digital asset funds. That brings the total for the year to a record-breaking $37.3 billion! But the story isn’t just about the overall numbers; there’s a fascinating shift happening under the surface.

Investor Sentiment Splits: ETH Up, BTC Down

The biggest news? Bitcoin (BTC) saw significant outflows of $457 million – its first major dip since early September. Experts think this is due to investors cashing in profits after Bitcoin nearly hit the $100,000 mark.

Meanwhile, Ethereum (ETH) is having a party. It raked in a massive $634 million in inflows, bringing its total for the year to a staggering $2.2 billion – surpassing its 2021 record! This shows a renewed belief in Ethereum’s potential.

XRP also saw a huge boost, with $95 million in inflows – a new record for the asset. This might be linked to the excitement around a possible US ETF approval.

Where’s the Money Coming From?

The US is leading the charge, accounting for $266 million of the total inflows. Hong Kong and Germany also saw healthy inflows, while Switzerland and Canada experienced outflows. This shows global interest in crypto, but the US is still the biggest player.

Ethereum and Bitcoin: A Tale of Two Cryptos

While Bitcoin has been making headlines recently, hitting new all-time highs, Ethereum is also making significant moves. Although it hasn’t surpassed its previous all-time high yet, ETH is trading above $3,600 – a nearly 50% increase in the last month! One analyst even predicts ETH could hit $10,000 based on historical patterns.

Bitcoin, meanwhile, is still a major player, currently trading around $97,130 – a 39.8% increase over the past month.