Last week, investors poured a ton of money into crypto, marking the biggest influx in five weeks. This surge is likely fueled by hopes that the Federal Reserve might soon lower interest rates.

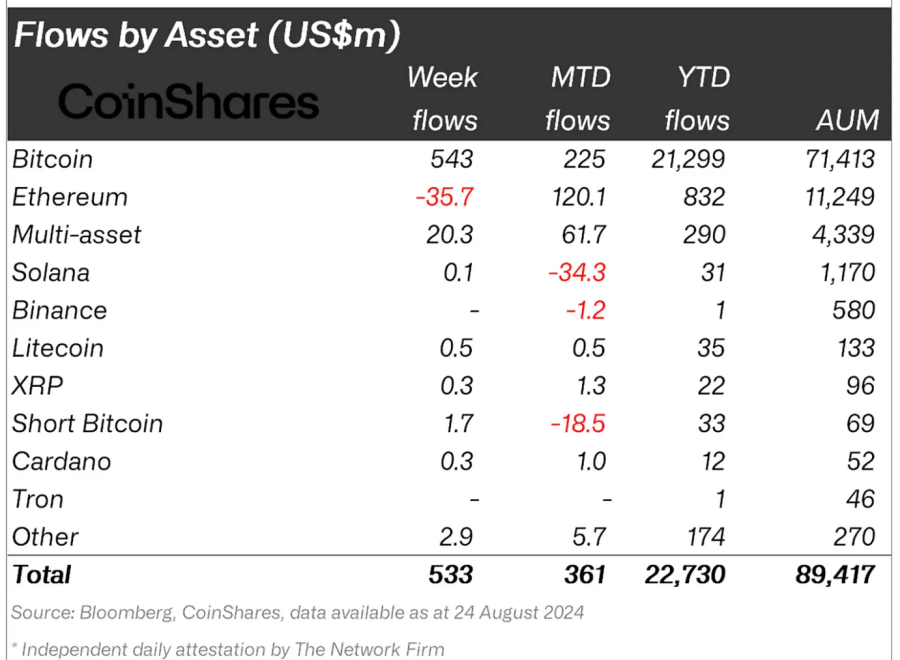

Bitcoin Leads the Charge

Bitcoin was the star of the show, attracting the majority of the new investments. This surge in interest came after Federal Reserve Chair Jerome Powell hinted at potential interest rate cuts as early as September 2024. Investors are excited about this possibility because lower interest rates could make risky assets like crypto more appealing.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a massive $318 million in inflows last week, with most of that happening on Friday after Powell’s comments. This shows how sensitive Bitcoin is to interest rate expectations.

Ethereum Takes a Dip

Ethereum, on the other hand, wasn’t as lucky. While new Ethereum ETFs continue to attract investments, overall, there was a net outflow of $36 million from Ethereum-related products. The Grayscale Ethereum Trust (ETHE) was a big contributor to this trend, with outflows exceeding the inflows seen in newer Ethereum ETFs.

Despite these outflows, new Ethereum ETFs have still managed to attract a hefty $3.1 billion since their launch in July.

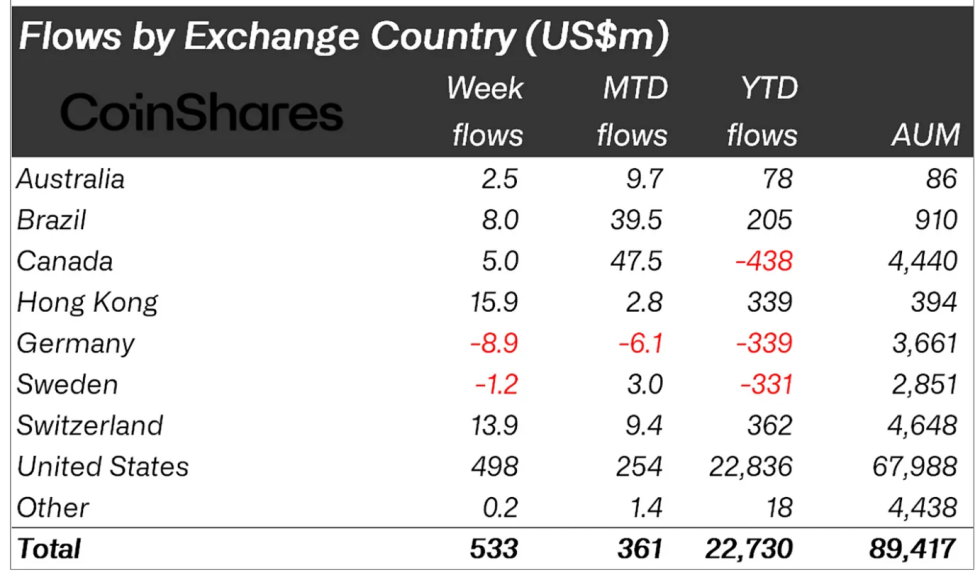

Where the Money is Flowing

The US was the top destination for crypto investments last week, attracting $498 million. Hong Kong and Switzerland also saw significant inflows. Germany, however, experienced minor outflows.