Veteran Investors Push Back Against Bear Market Predictions

Several prominent investors are dismissing the current downturn in the crypto market as a temporary correction, rather than the start of a full-blown bear market. Chris Burniske, a venture capitalist and former head of crypto at ARK Invest, argues that the recent price drops are simply a typical mid-bull market reset. He points to similar corrections in 2021, where Bitcoin, Ethereum, and Solana all experienced significant drops before ultimately reaching new highs. Burniske highlights that even with Bitcoin down 20%, Ethereum down 50%, and Solana down 51% from their all-time highs, this pattern isn’t unprecedented.

Historical Parallels and Patience

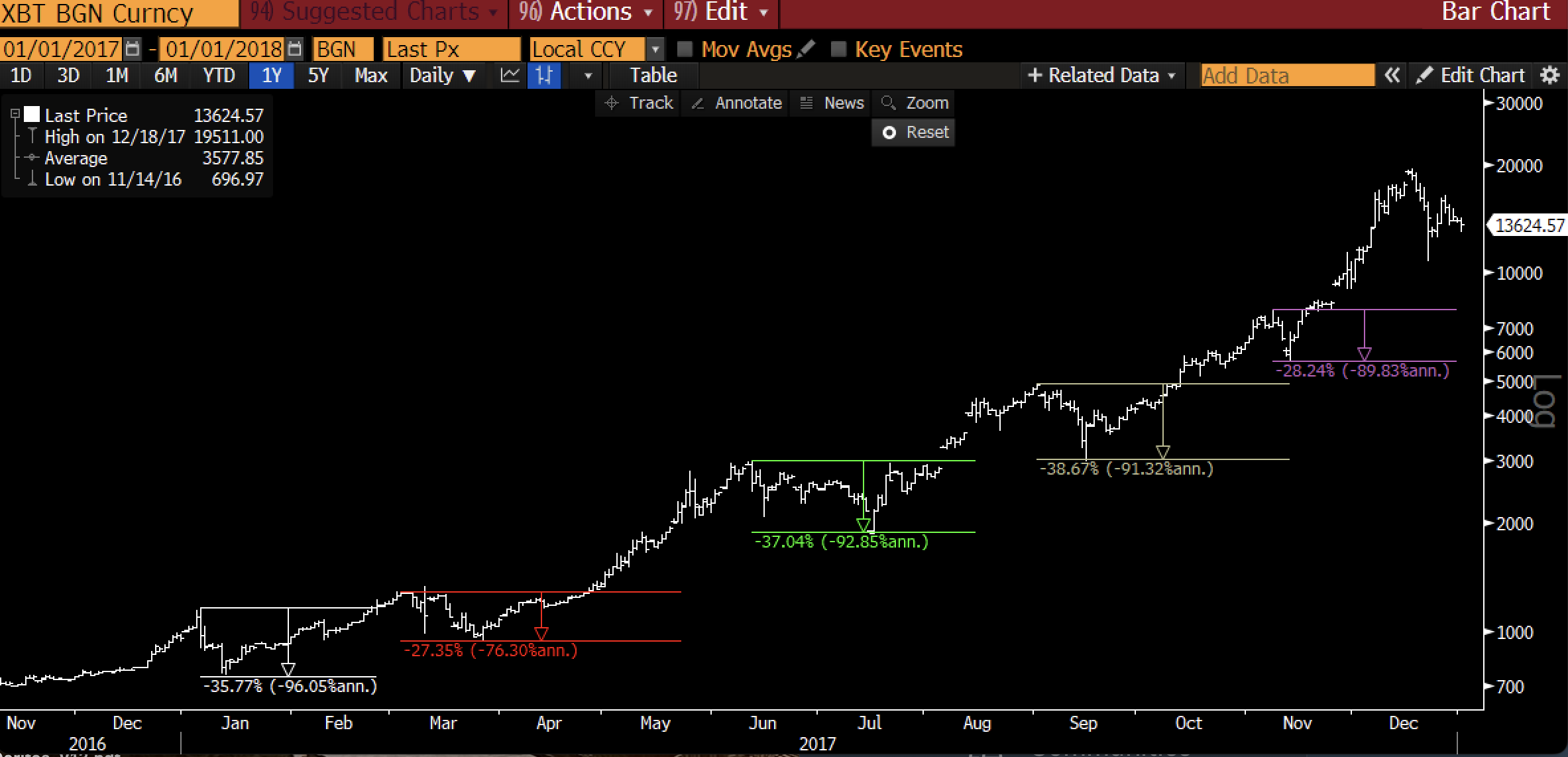

Burniske’s view is echoed by Raoul Pal, CEO of Real Vision, who also believes the current correction is a temporary setback. Pal draws parallels to the 2017 market, noting similar pullbacks in Bitcoin’s price followed by substantial gains. He emphasizes the need for patience, suggesting that focusing on short-term price fluctuations is unproductive.

The Takeaway: Hold Tight?

Both Burniske and Pal suggest that the current market dip is a normal part of a bull market cycle, not a signal of an impending bear market. They encourage investors to maintain a long-term perspective and avoid panicking over short-term price volatility. However, it’s crucial to remember that all investments carry risk, and this is not financial advice. Always conduct thorough research before making any investment decisions.