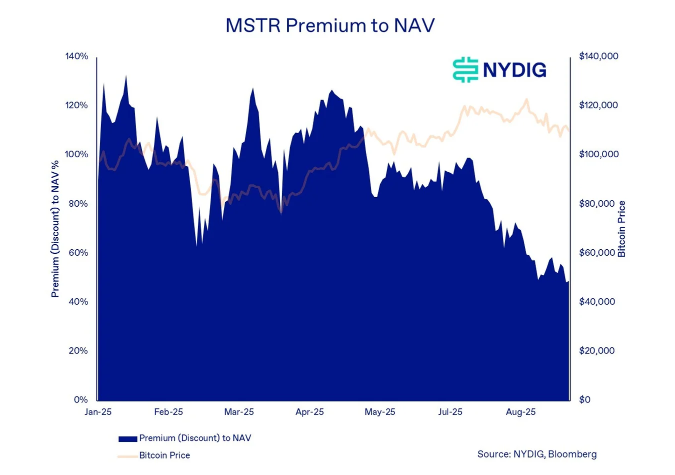

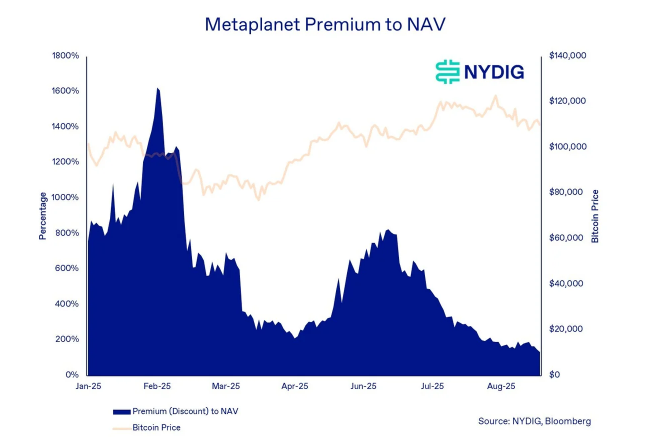

The hype around companies holding Bitcoin on their balance sheets is fading, according to NYDIG. Investors are becoming less enthusiastic, and it’s showing in the stock prices.

Shrinking Premiums: What’s Going On?

The difference between a company’s stock price and the value of its Bitcoin holdings (its net asset value or NAV) is shrinking. This is happening even though Bitcoin’s price has been high recently. Several factors are at play:

- Upcoming Bitcoin Releases: Worries about future Bitcoin releases are impacting stock prices.

- Changing Company Goals: Some companies are shifting their focus away from Bitcoin.

- New Stock Sales: Companies issuing more shares dilutes the value of existing shares.

- Profit-Taking: Investors are cashing in their profits.

- Lack of Differentiation: Many companies holding Bitcoin look pretty much the same to investors.

Companies like Metaplanet and Strategy, often seen as Bitcoin proxies, are seeing this gap close significantly. Stocks that previously traded at a premium to their Bitcoin holdings are now much closer to their actual value.

Buying Slowdown

Publicly-traded companies holding Bitcoin hit a peak of 840,000 BTC earlier this year, with Strategy holding a massive 637,000 BTC. However, buying activity has significantly slowed down.

- Strategy’s average purchase:

Dropped from 14,000 BTC in 2025 to 1,200 BTC in August.

Dropped from 14,000 BTC in 2025 to 1,200 BTC in August. - Other companies: Bought 86% less Bitcoin in August compared to their March 2025 peak.

- Monthly growth: Has cooled dramatically for both Strategy and other companies.

Stock Prices Under Pressure

Many of these companies are now trading at or below the price of their recent fundraising rounds. This is risky. If newly issued shares are sold, it could trigger a wave of selling, further depressing prices.

NYDIG advises companies to take steps to support their share prices. One suggestion is to buy back their own shares, reducing the number of outstanding shares and potentially boosting the price.

A Rocky Road Ahead?

Bitcoin’s price itself is volatile. Recent dips show how easily the value of these companies can be affected. Their stock prices can fluctuate independently of Bitcoin’s price, sometimes even more dramatically. The future looks uncertain for these crypto-focused companies.