Chinedu Albert, a legal expert specializing in Nigerian tech and innovation, has shed light on the challenges hindering the adoption of eNaira, the digital currency introduced by the Central Bank of Nigeria (CBDC). According to Albert, these challenges can be traced back to a previous ban on cryptocurrencies enforced by the government.

In an exclusive interview with Cointelegraph on December 29, Albert expressed that the eNaira is an ambitious concept, but it reflects the government’s response to its “ill-advised” decision to ban cryptocurrencies and virtual assets on February 5, 2021.

Nigeria’s Impressive Crypto Adoption in 2021

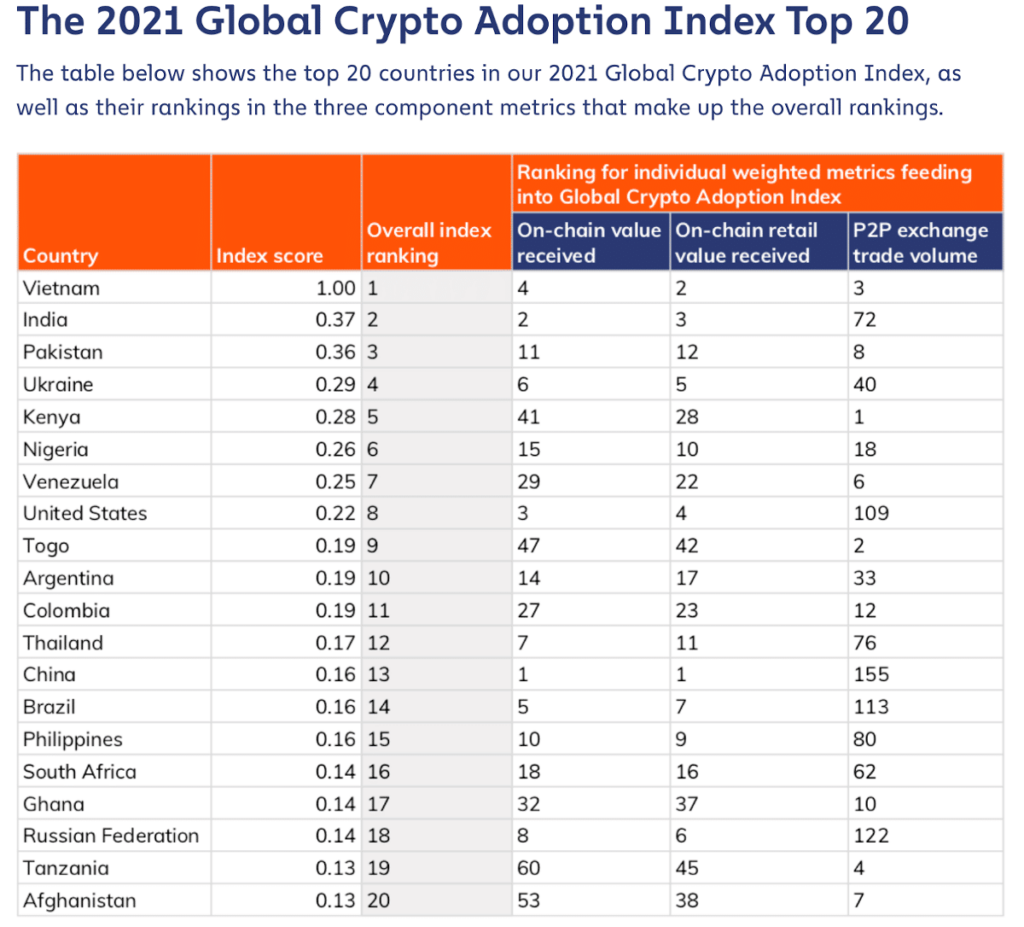

In 2021, Chainalysis data revealed that Nigeria ranked sixth in the Global Crypto Adoption Index, with a score of 0.26%, slightly ahead of the United States at 0.22%. Despite this achievement, Albert argues that the eNaira faces challenges due to its susceptibility to government policies and inflation, factors that have contributed to its slow adoption.

eNaira’s Struggle for Acceptance

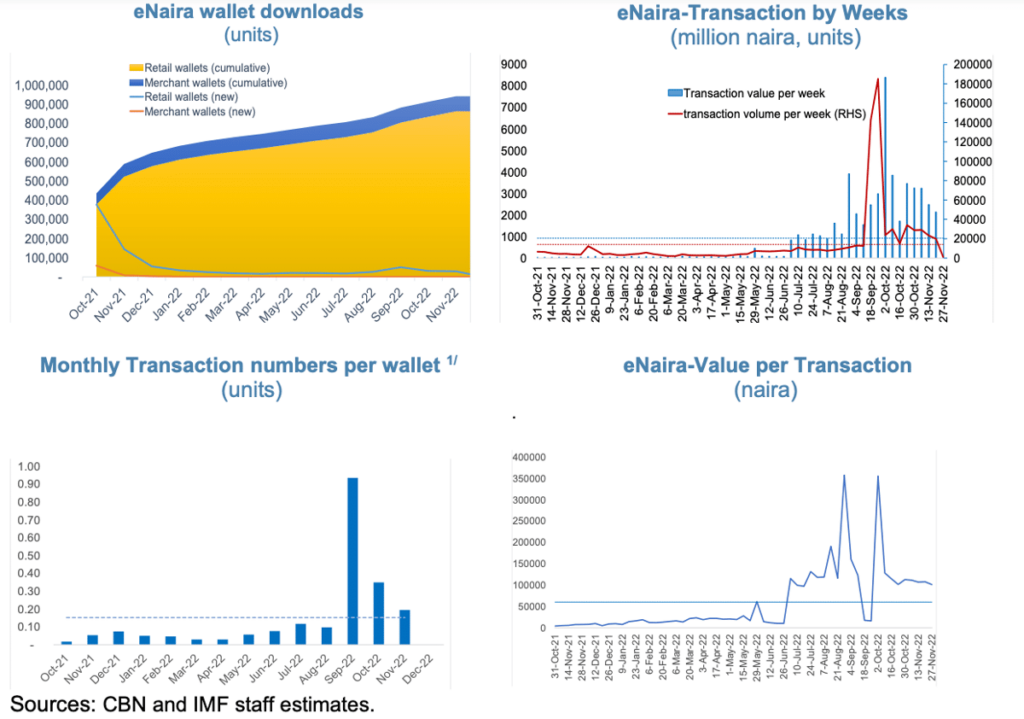

The eNaira was launched on October 25, 2021, becoming the world’s second public CBDC after the Bahamas’ Sand Dollar project. However, despite this milestone, the digital currency is grappling with adoption hurdles two months into its second anniversary.

According to a May 2023 report from the International Monetary Fund (IMF), weekly eNaira transactions averaged only 14,000, representing just 1.5% of monthly transactions per wallet. This data reveals that 98.5% of wallets remained inactive on any given week.

Albert emphasizes that for eNaira adoption to succeed, Nigerians must have more confidence in the national currency, the naira, and the central authority overseeing it. Building trust among Nigerians and improving the credibility of the naira are key factors in the adoption process.

Practical Challenges and Skepticism

Digital finance expert Mr. Tobi Aremotobi, based in Nigeria, shared his experience with eNaira, highlighting practical challenges. He noted that while the phrase “I’ll pay you with eNaira” was used jokingly, spending money from the eNaira wallet posed significant hurdles. Most merchants in Nigeria do not accept the digital currency, and many tech-savvy individuals remain unconvinced about blockchain-based currency for mainstream use.

While the ban on digital assets for Nigerian banks and financial institutions was officially lifted on December 23, enthusiasm for eNaira remains limited. Concerns about future crypto regulations also contribute to this reluctance.

A Ray of Hope for eNaira?

The IMF report on eNaira emphasizes its goal of addressing Nigeria’s substantial informal economy and improving transparency in informal payments. To achieve this, eNaira aims to integrate with existing mobile money frameworks. This involves either utilizing established local mobile money networks like Kuda, oPay, and Flutterwave or creating a retail access network.

The partnership between the CBN and the African-focused fintech firm Flutterwave to introduce eNaira as a payment option for merchants and financial institutions is seen as a strategic move to boost adoption. However, IMF data views it as a de-risking measure that may not align with Nigeria’s mobile money market, where cash transactions are predominant.