It seems like cryptocurrencies and the stock market are getting cozy. According to Coinbase, these two markets are now moving together more than ever, with a correlation of about 50% as of September 2024. This newfound connection is mainly due to the global monetary easing policies being implemented by countries like the US and China.

The Fed’s Influence

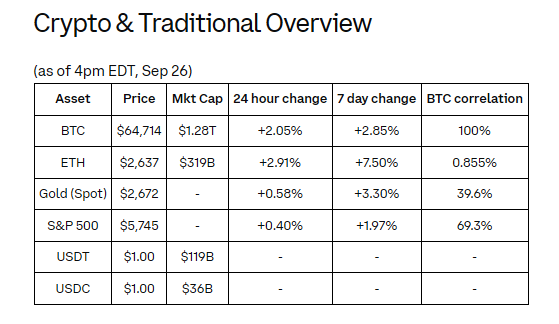

The Federal Reserve’s recent aggressive interest rate cuts have played a major role in this trend. After a recent 50-basis-point rate drop, Bitcoin and crypto-related stocks saw a surge. Bitcoin hit a new high above $64,000, while companies like Microstrategy and Coinbase also experienced strong growth. This synchronized movement suggests that both asset classes respond positively to measures designed to stimulate economic growth.

Interestingly, Bloomberg data shows that US equity futures prices have been mirroring cryptocurrency prices. As Bitcoin climbed, many US equities also reached new highs. This suggests a deeper correlation in how investors perceive risk in both markets.

Caroline Mauron, co-founder of Orbit Markets, believes that macroeconomic factors are currently driving crypto prices, and this trend is likely to continue throughout the Fed’s easing cycle.

A Changing Landscape

Cryptocurrencies used to operate independently of traditional financial markets. However, as these digital assets mature, they’re becoming more sensitive to macroeconomic conditions. This is evident in Coinbase’s findings, which show that Ethereum has outperformed Bitcoin during this period of increased correlation. Ethereum’s 8% gain over Bitcoin in the week following the Fed’s announcement suggests a potential shift in investor interest towards altcoins.

Despite Ethereum’s strong performance, investors are still concerned about recent sell-offs by the Ethereum Foundation. The foundation recently sold 100 ETH, bringing the total ETH sold this year to over 3,500. These actions could impact market sentiment and the continued growth of projects within the Ethereum network.

What’s Next?

As the link between the crypto and stock markets strengthens, investors are re-evaluating their strategies. More people in the crypto space are exploring areas beyond Bitcoin and Ethereum, such as options. Memecoins like Shiba Inu and PEPE have gained popularity, and certain sectors, like gaming and Layer 2 solutions, have seen impressive gains of up to 17% in a single week.

With October traditionally being a strong month for cryptocurrencies, there’s speculation that favorable market conditions could lead to further price increases in both asset classes. The increasing participation of institutional investors in crypto markets has also contributed to this trend, as their trading patterns often align with those of stocks.