A popular crypto analyst believes Bitcoin (BTC) and Ethereum (ETH) might have hit their lowest points for now.

Bitcoin’s Bullish Signals

According to Rekt Capital, a well-known trader with a large following on X (formerly Twitter), Bitcoin’s Relative Strength Index (RSI) – a measure of price momentum – is showing positive signs. He points out that it’s close to breaking through a downward trendline that’s been in place since November 2024. He also highlights a potential price jump to fill a “CME gap,” potentially pushing Bitcoin as high as $87,000. A CME gap refers to a price difference between Bitcoin’s closing price on Friday and its opening price on Monday on the Chicago Mercantile Exchange. These gaps often get filled. At the time of writing, Bitcoin is trading around $84,611, up nearly 4% in the last 24 hours.

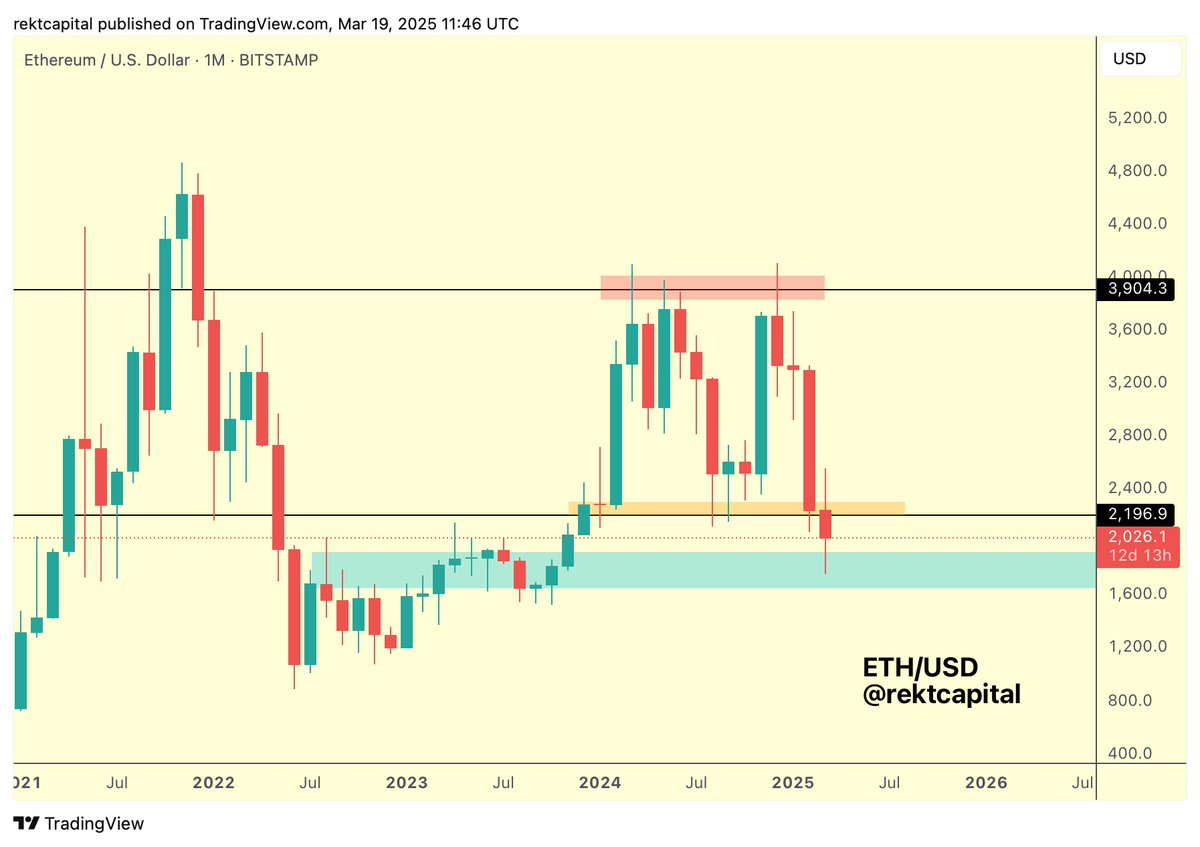

Ethereum’s Potential Uptrend

Rekt Capital also sees positive signs for Ethereum. He suggests ETH is entering a key support area that has historically triggered price rallies. A strong reaction here could send ETH back into a higher price range, potentially reaching $3,900. If this happens before the end of March, the recent dip below $2,200 would be seen as a temporary setback. Ethereum is currently trading around $2,048, up almost 9% in the last 24 hours.

Disclaimer:

/p>