CryptoQuant’s CEO, Ki Young Ju, thinks a bold idea could work: using Bitcoin to tackle the US national debt. He shared his thoughts on X (formerly Twitter), suggesting that a strategic Bitcoin reserve could make a significant dent.

Bitcoin’s Growing Market Cap

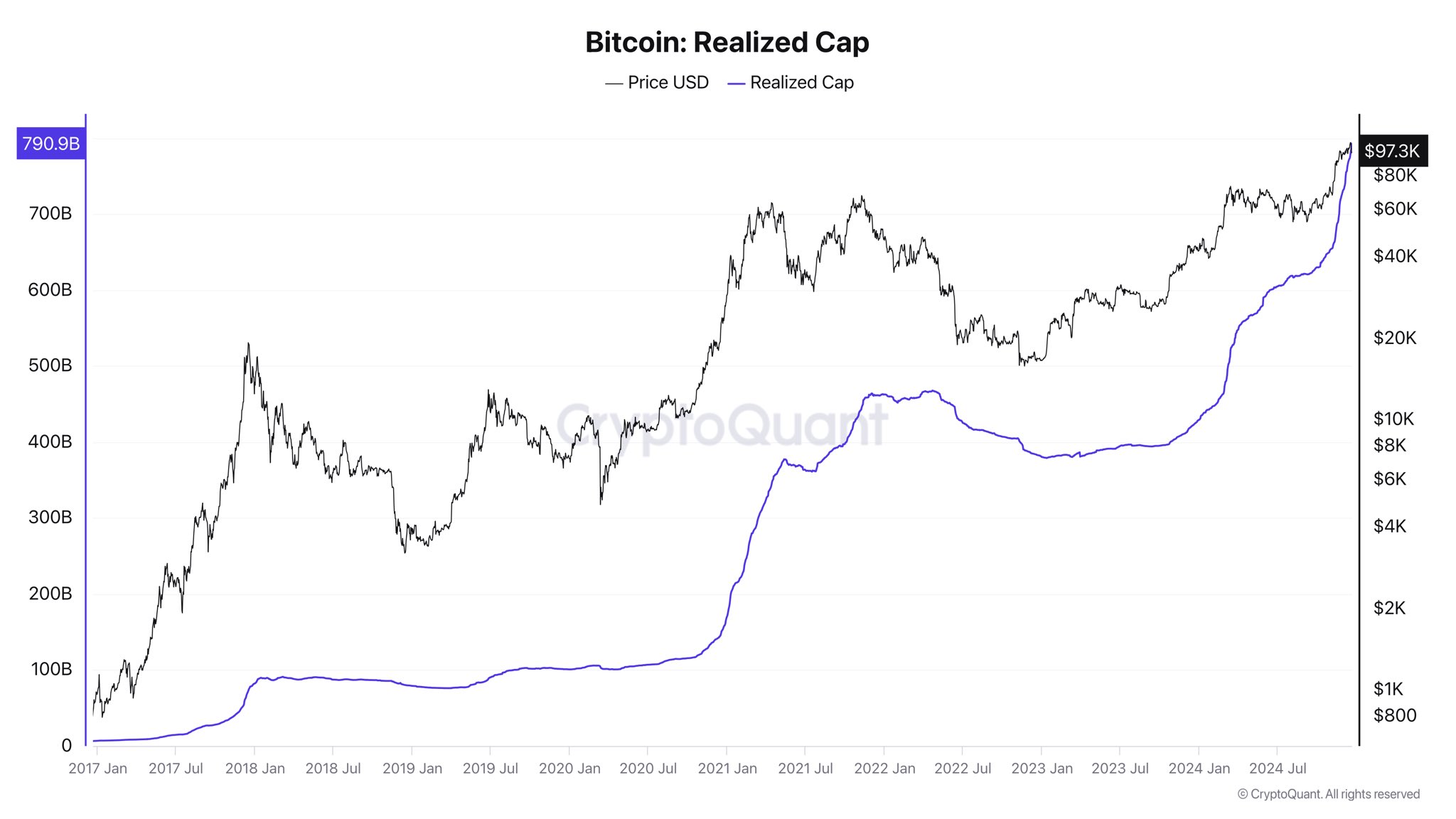

Ju points out Bitcoin’s impressive growth. Over the last 15 years, massive capital inflows have boosted its market cap to $2 trillion. This year alone, $352 billion in inflows added another trillion. He acknowledges that using a volatile asset like Bitcoin to offset dollar-denominated debt is a challenge, but believes it’s not impossible.

A Strategic Bitcoin Reserve (SBR)

For Bitcoin to be seriously considered, Ju argues it needs to gain the same level of global acceptance as gold. Creating a Strategic Bitcoin Reserve (SBR) would be a big step in that direction. Since 70% of US debt is held domestically, buying 1 million Bitcoin by 2050 could offset 36% of that debt, if the government officially recognized Bitcoin as a strategic asset.

Challenges and Risks

Ju admits that foreign debt holders (30% of the total) might be hesitant. However, he remains optimistic, saying that if a global consensus on Bitcoin’s value is reached, it’s achievable. The main risk, he says, would be large Bitcoin holders (“whales”) suddenly selling off their holdings to manipulate the market. But, he believes that if governments continue accumulating Bitcoin and its price keeps rising, this scenario is unlikely.

A VanEck Perspective

VanEck’s head of digital assets research, Matthew Sigel, also explored this idea. His model suggests that if the US Treasury bought 1 million Bitcoin over five years, starting at $200,000 per coin, and assuming certain growth rates for both Bitcoin and the national debt, the Bitcoin reserve could represent 36% of the US debt by 2050. This scenario would put Bitcoin’s price at a whopping $42 million per coin.

Disclaimer:

This information is for general knowledge and discussion only and does not constitute financial advice. Investing in cryptocurrencies is risky. Do your own research before making any investment decisions./p>