A Boston hedge fund has snapped up $363 million worth of Bitcoin exchange-traded funds (ETFs).

Holdings Breakdown

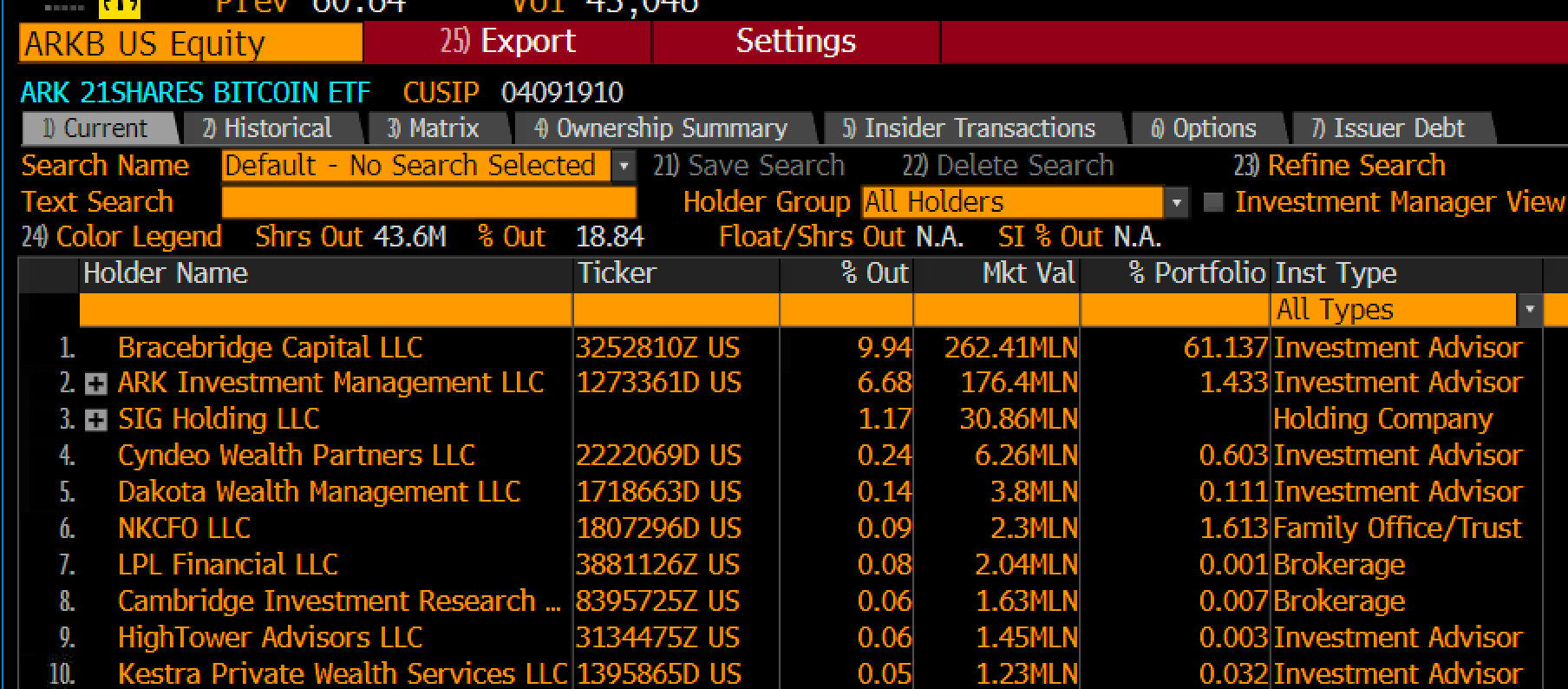

According to Bloomberg analyst Eric Balchunas, Bracebridge Capital owns:

- $262 million in ARK 21Shares Bitcoin ETF (ARKB)

- $81 million in BlackRock’s iShares Bitcoin Trust (IBIT)

- $20 million in Grayscale Bitcoin Trust ETF (GBTC)

Bracebridge’s Investments

Bracebridge manages around $12 billion in assets and invests in companies like:

- Biotech firm Alvotech

- Holding company Ambac Financial

- Security solutions firm ADT

Institutional Interest

Other major financial institutions are also holding Bitcoin ETFs for clients:

- JPMorgan: $760,000 worth

- Wells Fargo: 2,245 shares of GBTC worth $123,000

This shows growing institutional interest in Bitcoin and its potential as an investment.