The bond market is in chaos. Experts are calling it “broken,” with a massive and rapid sell-off causing huge price swings.

A Historic Drop

The 30-year US Treasury yield jumped incredibly fast – a move not seen since 1982. This isn’t just some slow market adjustment; it’s a full-blown liquidation. Several financial analysts have voiced serious concerns on social media. They’re pointing fingers at a leveraged trading strategy called the “basis trade” that’s now unraveling.

The Basis Trade Backfires

This basis trade, popular during years of low interest rates, is now causing major problems. As hedge funds unwind their positions, bond prices are plummeting and yields are spiking. This is eroding the traditional safety of US Treasuries.

Trump’s Tariffs Add Fuel to the Fire

President Trump’s new tariffs are making things even worse. They’re fueling fears of inflation and a possible recession, further destabilizing the market. The situation is worsened by a significant drop in crude oil prices.

The Fallout: Bitcoin’s Uncertain Future

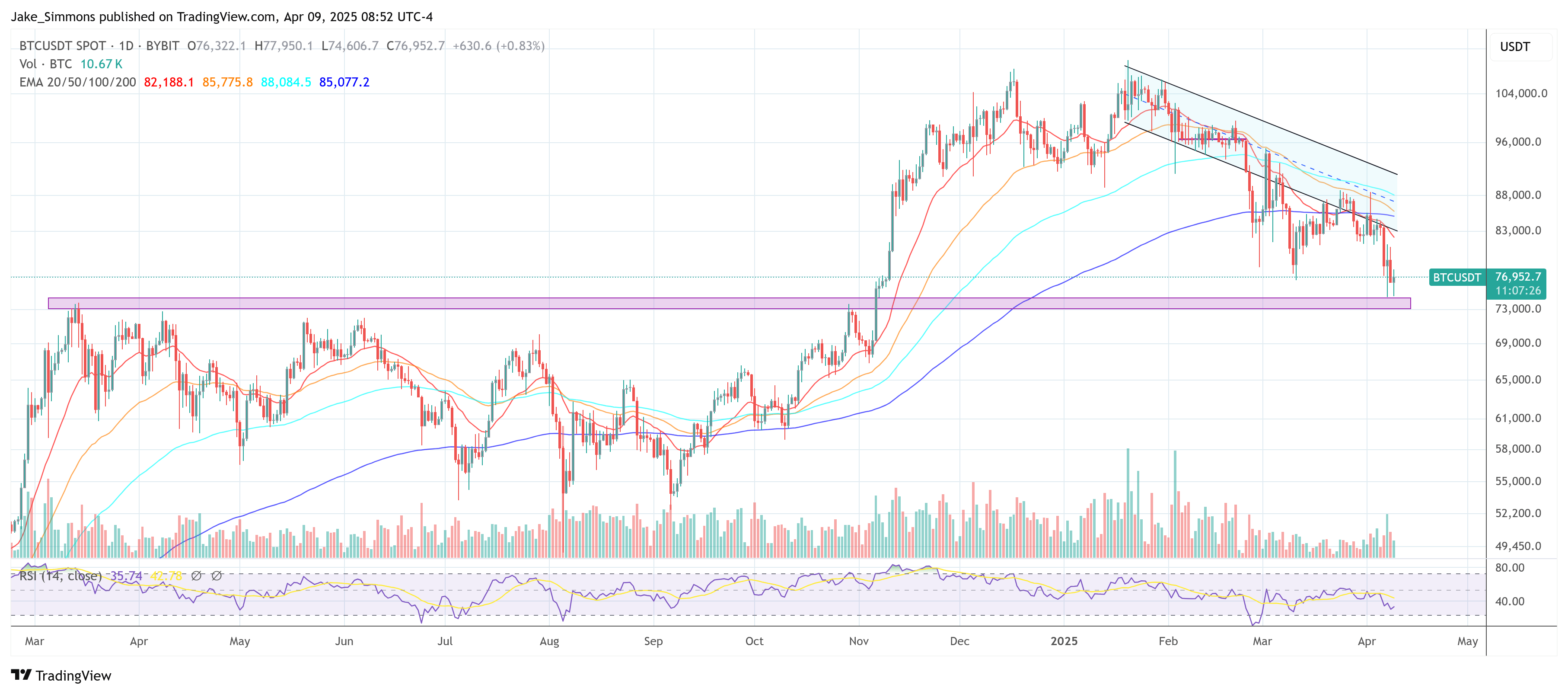

This market turmoil has huge implications for Bitcoin and other cryptocurrencies. While often seen as a safe haven, Bitcoin’s price has recently moved in line with traditional assets. The current bond market crash is dragging Bitcoin down.

However, there’s a silver lining for some. Some believe that a potential Federal Reserve intervention (like an emergency rate cut) could actually boost Bitcoin’s price. Others are even more bullish, suggesting that a collapse of the global sovereign debt market could send investors flocking to Bitcoin as a safer alternative. The ongoing debate is whether the sell-off is driven by foreign governments unloading US Treasuries or by domestic issues.

What Happens Next?

The situation is volatile. Will the Fed step in? Will the crisis deepen? No one knows for sure. But one thing’s clear: this is a significant event with potentially huge consequences for the global economy, including the crypto market. At the time of writing, Bitcoin was trading at $76,952.