Pantera Capital, a digital asset investment firm, believes blockchain technology is actually strengthening the US dollar’s global dominance, not weakening it. This goes against the long-held idea that the dollar’s influence is declining internationally.

Blockchain: A Digital Shield for the Dollar?

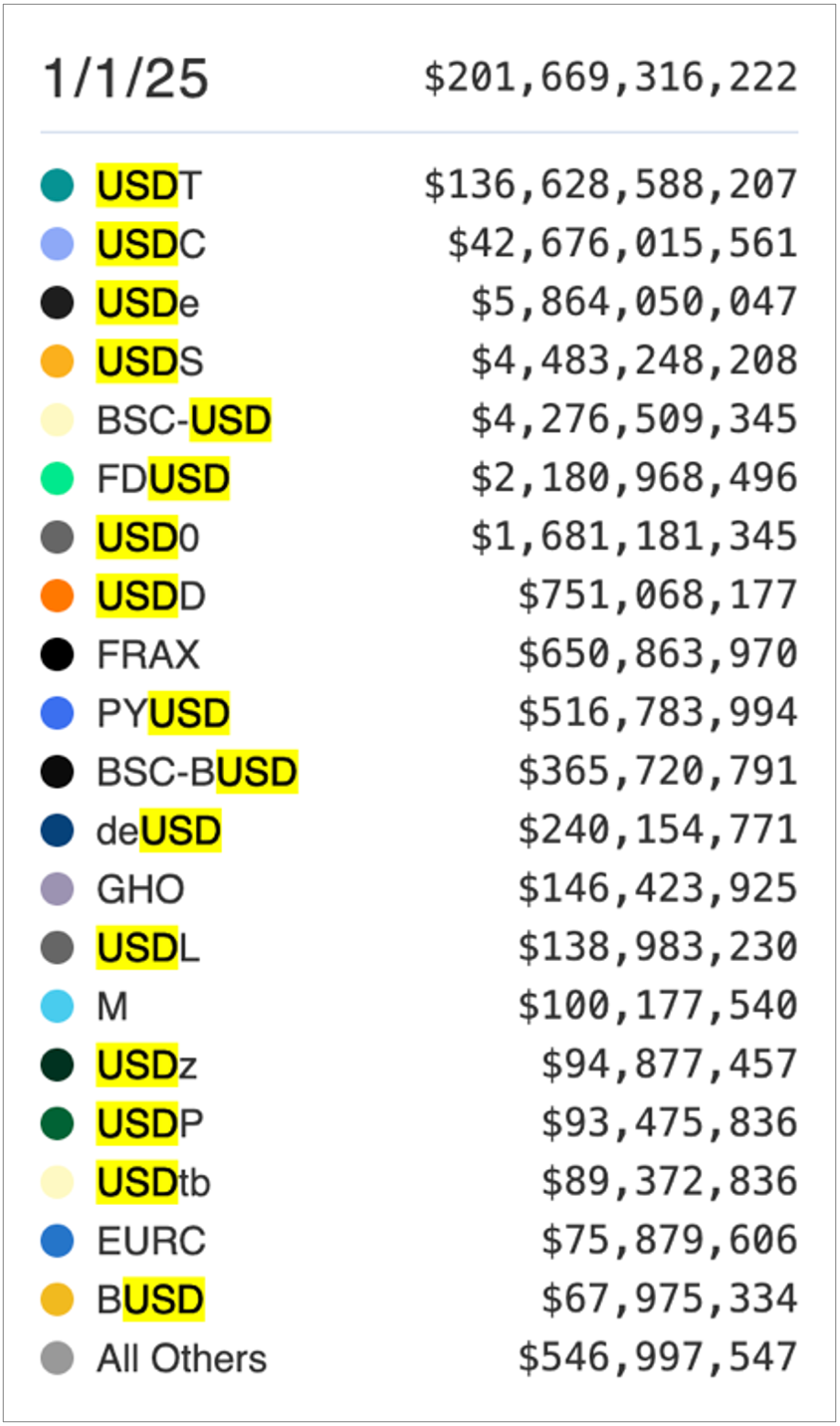

According to Pantera’s Jeff Lewis and Erik Lowe, blockchain creates a new digital infrastructure that supports the dollar. They argue that the ability to easily move and represent dollar assets globally using blockchain keeps the dollar vital, even with geopolitical pressures pushing for alternatives. They point out that the US dollar’s core strengths—strong markets, legal systems, and transparency—remain unmatched, and stablecoins extend these benefits to a borderless digital world. Noticeably, most major stablecoins even have “USD” in their names.

Bitcoin: Store of Value, Not Dollar Killer

Pantera also notes a shift in how Bitcoin is viewed. It’s increasingly seen as a way to store value, not as a replacement for the US dollar. The firm argues that stablecoins linked to real-world assets (RWAs) fulfill Bitcoin’s original promise of a stable and potentially profitable exchange medium, ultimately boosting, not harming, the dollar’s importance.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies or other high-risk assets.

/p>