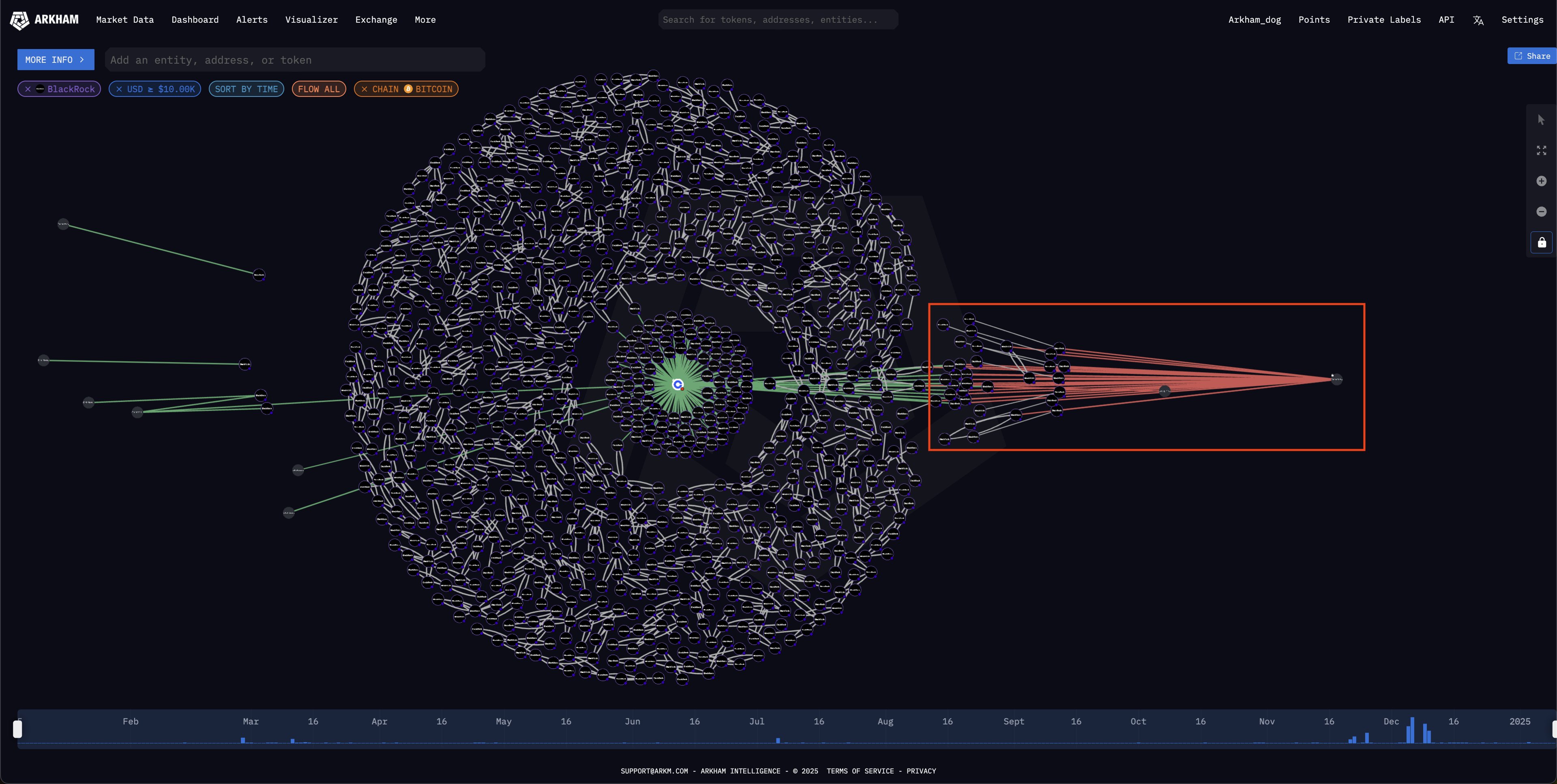

BlackRock’s Bitcoin Bonanza (and Sell-Off)

Data analytics firm Arkham revealed that investment giant BlackRock quietly amassed a whopping $50 billion worth of Bitcoin (BTC) in 2024. That’s not all; MicroStrategy added another $24 billion to their BTC holdings, and Fidelity chipped in with $20 billion. BlackRock also invested in other cryptocurrencies, including $3.6 billion in Ethereum (ETH) and $68.5 million in USDC.

A Change of Heart?

However, the story doesn’t end there. Arkham also reports that BlackRock, which manages over $10 trillion in assets, has apparently shifted gears. Instead of continuing to buy Bitcoin, they’ve started selling it off recently.

Record Outflows

This shift is supported by recent news of record outflows from BlackRock’s Bitcoin ETF (IBIT). On January 2nd, $332.6 million flowed out – the highest single-day outflow ever recorded for the fund. Interestingly, IBIT even surpassed BlackRock’s gold ETF (IAU) in net assets last November, reaching over $33 billion despite the gold ETF launching much earlier.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading at $94,201, down 1.1% in the last 24 hours.

Disclaimer: This information is for general knowledge only and is not financial advice. Always do your own research before investing in cryptocurrencies.