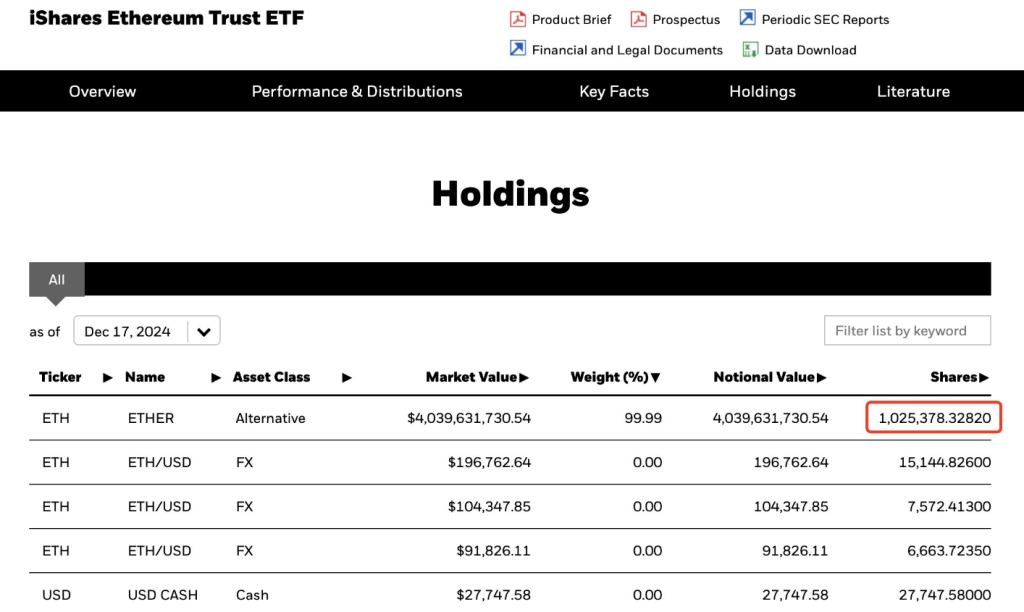

BlackRock’s iShares Ethereum Trust ETF (ETHA) just hit a huge milestone: it now holds over 1 million ETH, worth over $4 billion! This is a massive achievement, especially considering the fund only launched six months ago in July 2024.

Institutional Investors are Loving Ethereum

This isn’t just about BlackRock; it’s part of a larger trend. Big companies are pouring billions into crypto ETFs, particularly Bitcoin and Ethereum, throughout 2024. ETHA’s success is even more impressive when you compare it to other Ethereum ETFs. For example, Grayscale’s Ethereum ETF only holds around 476,000 ETH.

A Rocky Start, a Strong Finish

Ethereum ETFs had a slow start, struggling to attract investment initially. However, things changed dramatically around September 2024. Positive market sentiment, possibly fueled by events like Donald Trump’s election win, led to a huge surge in investment. In fact, Ether ETFs saw over $850 million in new money just last week!

A Bright Future for Ethereum?

Experts are optimistic about Ethereum’s future. One analyst believes Ether is poised for a big comeback in 2025, predicting that the market for real-world assets on Ethereum could generate over $100 billion in annual fees. The massive inflow of cash into Ethereum ETFs shows that institutional investors are increasingly confident in the cryptocurrency. Total assets across various Ethereum ETFs have now surpassed $14 billion. This makes it easier for investors to get involved in Ether without the complexities of managing their own crypto wallets.

Looking Ahead: Challenges Remain

While things look good, BlackRock acknowledges that Ethereum ETFs still have a way to go to catch up to their Bitcoin counterparts. The market and regulations are constantly changing, so there will be challenges ahead. However, with strong institutional backing and growing interest from traditional finance, the future looks bright for BlackRock’s Ethereum ETF and the broader crypto market in 2025.