Growing Popularity of Bitcoin ETFs

Bitcoin (BTC) is gaining traction among asset managers and traditional financial institutions, leading to the success of Bitcoin ETF products. BlackRock, Grayscale, and Fidelity have all launched successful ETFs, attracting significant investment.

BlackRock’s ETF Expands Authorized Participants

BlackRock’s iShares Bitcoin Trust (IBIT) ETF has added five new authorized participants (APs): Goldman Sachs, Citadel, Citigroup, UBS, and ABN AMRO. This brings the total number of APs to nine.

Role of Authorized Participants

APs play a crucial role in ETF ecosystems. They have the right to create and redeem ETF shares in response to market demand. This helps increase efficiency and reduce costs for investors.

Wall Street Giants Embrace Bitcoin ETFs

The addition of high-profile institutions like Goldman Sachs and Citigroup to BlackRock’s AP list signals growing interest and acceptance of Bitcoin-related financial products. These institutions may have a newfound interest in the sector or are now comfortable associating with it publicly.

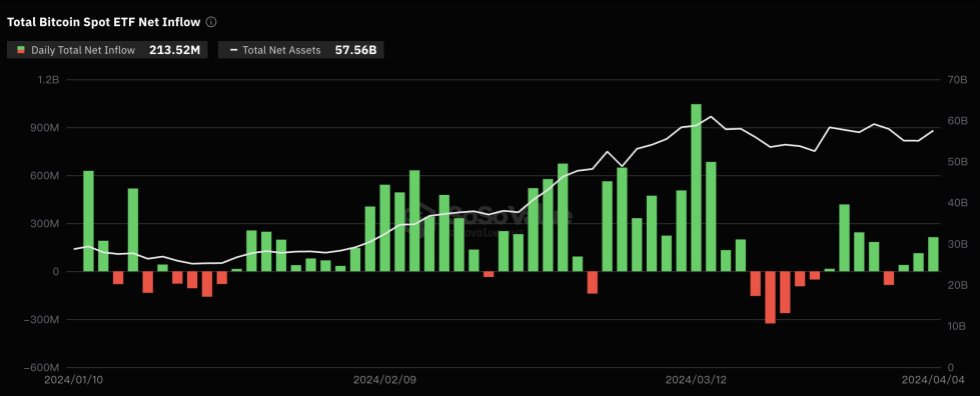

Market Flows

Spot ETFs approved by the SEC have seen steady investor interest. On April 4, these ETFs had a net inflow of $213 million, while Grayscale’s GBTC experienced a net outflow of $79.3 million. BlackRock’s IBIT ETF had a net inflow of $144 million, bringing its total net inflow to $14.4 billion.

Bitcoin Price

Despite the success of Bitcoin ETFs, BTC’s price has remained relatively stable, trading around $67,700.