Ethereum’s price has been on a wild ride lately, shooting up and then hitting a wall. After briefly topping $3,800, it’s now facing some resistance. Will it keep climbing, or is a cool-down coming?

BlackRock’s Massive Ethereum Purchase

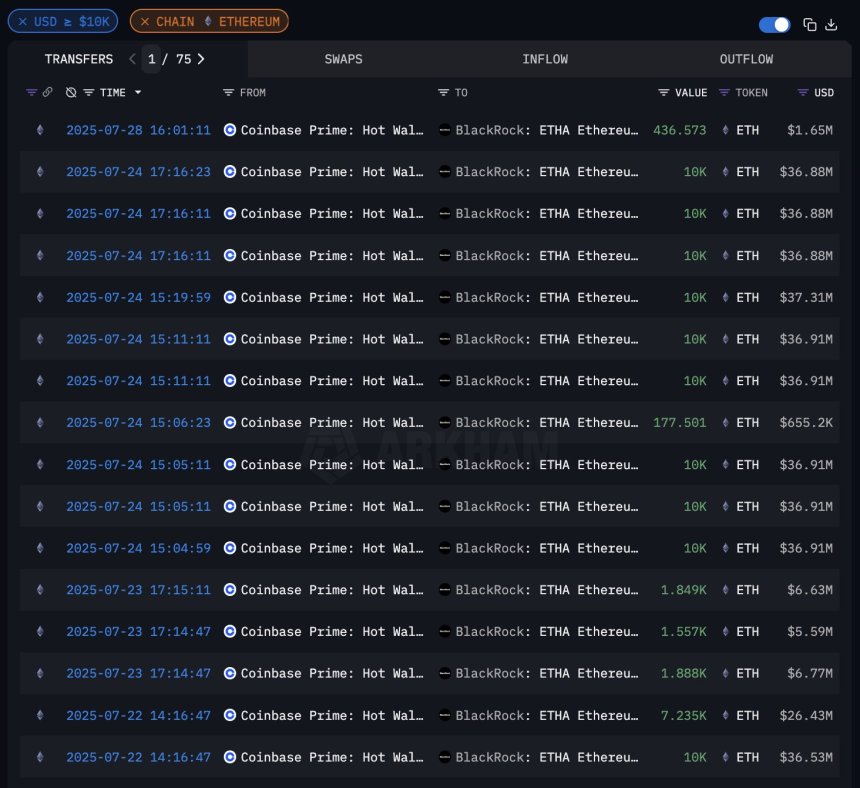

Adding fuel to the fire, new data shows BlackRock went big on Ethereum last week. They bought over four times more ETH than Bitcoin – a whopping $1.2 billion worth of ETH compared to just $267 million in BTC. This huge investment shows institutions are increasingly confident in Ethereum’s future. It’s a major signal that Ethereum is gaining traction with big players in traditional finance.

This isn’t a sudden shift. Institutional interest in ETH has been growing since April, fueled by clearer regulations, progress on ETFs, and Ethereum’s growing role in the financial world. BlackRock’s recent purchase is just the most dramatic example of this trend.

Ethereum’s Price: A Crossroads

Ethereum’s price has skyrocketed recently, going from under $2,000 to around $3,782. It broke through some serious resistance, but now it’s struggling to get past $3,800. A strong close above this level could send it towards $4,200-$4,400. However, if it can’t break through and falls below $3,500, we might see a short-term price drop as investors take profits. The long-term picture still looks bullish as long as it stays above $2,850.

In short, the situation is exciting but uncertain. BlackRock’s move is a major vote of confidence in Ethereum, but the price is facing a crucial test. Whether it breaks through resistance or pulls back remains to be seen.